Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Lately, every headline screams AI bubble.

Nvidia’s priced for perfection. Palantir trades like it’s the next central bank. Wall Street can’t decide if hyperscaler capex is a miracle or a mirage.

Everyone is arguing about GPUs, depreciation schedules, accounting gimmicks, model cycles, and whether training chips will survive long enough to justify their costs.

But while the entire market debates the AI melt-up…

another risk is quietly rebuilding in the background — the same one that detonated in 2008.

And almost nobody is talking about it.

Housing Risk 2.0

Michael Burry just shut down his hedge fund, admitting his view of value is “not in sync with the markets.” Investors mocked him for betting against AI stocks — but ironically, the next Big Short might not be in Silicon Valley…

It might be in the suburbs.

And the signs are piling up:

❗ 50-Year Mortgages Get Floated in Washington

The administration is exploring 50-year mortgages — branded as a “complete game changer.”

At first glance, it sounds brilliant: smaller monthly payments, easier entry for first-time buyers. Sure, the monthly payment drops. But the total interest paid nearly doubles.

A $425,000 mortgage at 6.5% over:

30 years: $542,064 interest

50 years: $1,012,478 interest

That’s an extra $470,414 for a $290/month discount.

❗ Equity Builds at Glacier Speed

With a 50-year mortgage, it can take 31 years just to pay off the first $100K of principal. That’s not homeownership — that’s permanent renting disguised as ownership.

❗ Over 53% of Home Values Declined YoY (Zillow)

The highest share since 2012.

Not a crash… but a quiet erosion.

❗Midwest & Northeast Overvaluation

Markets like Detroit, Cleveland, and New Haven are 20–33% overpriced relative to long-term trends.

Weak equity + overpriced markets = dangerous mix.

❗The Lock-In Effect Has Paralyzed the Market

Homeowners with 3% mortgages won’t sell.

Inventory is frozen.

Mobility is dead.

Affordability is shattered.

But instead of fixing the core affordability issue, mortgage terms are being stretched longer and longer as a workaround, even though the math behind it hasn’t improved.

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

Why This Matters More Than the AI Bubble

Here’s the part traders should focus on — the structural mechanics.

→ Default Risk Rises

Slow equity buildup means borrowers stay underwater longer.

Underwater loans = higher losses for lenders and MBS investors during downturns.

→ Prepayment Risk Skyrockets

Anytime a borrower:

refinances

moves

or makes extra payments

…the expected MBS cash flows collapse.

This risk is massive when the mortgage is 50 years long.

→ Duration Risk Expands Sharply

A 50-year mortgage is not a simple extension —

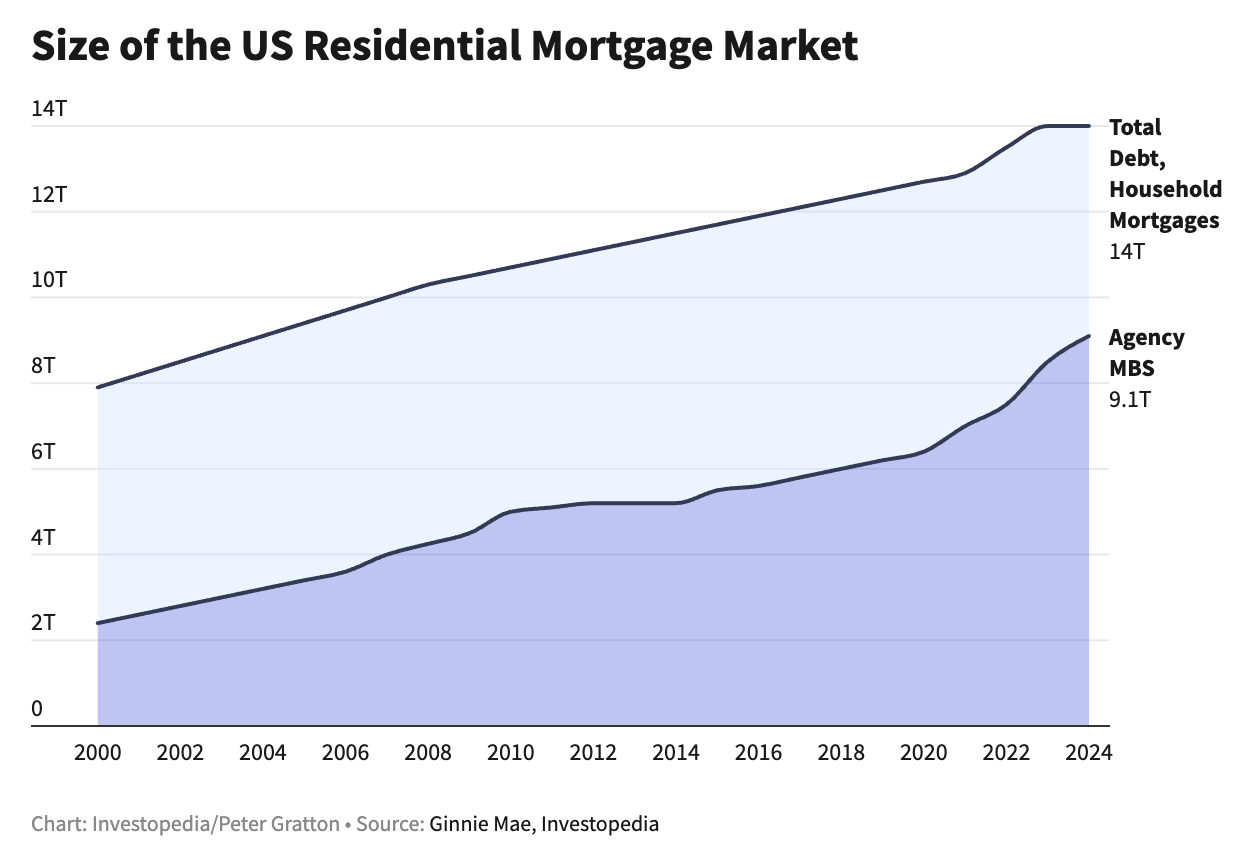

it reshapes interest-rate exposure across the entire $11T MBS market.

→ Investor Complacency Is Alarming

The iShares MBS ETF is up 4% YTD. Markets aren’t pricing any of this risk in.

Meanwhile, Burry steps away from the market — unable to reconcile fundamentals with investor behavior.

That should make every trader pause.

Lesson of the Day:

Mortgage-Backed Securities in One Page

Mortgage-backed securities (MBS) sit quietly in the background of the financial system, but they’re far from small. More than $11 trillion worth of them are outstanding — meaning a huge portion of American mortgages end up inside these investment products.

The idea is simple:

Banks bundle thousands of home loans together, turn them into a tradable security, and pass the monthly mortgage payments through to investors. If homeowners pay on time, investors get a steady stream of income. If they refinance or stop paying, the cash flow changes.

There are two main flavors:

- Agency MBS, backed by Fannie Mae or Freddie Mac, which are viewed as the safer end of the market.

- Non-agency MBS, issued by private lenders, which offer higher yields but more credit risk.

MBS were at the center of the 2007–08 crisis, when shaky loans and rising defaults caused these securities to unravel. Regulations have tightened since then, but the same core risks still matter:

Prepayments can cut expected returns

Rising rates can push MBS prices down

Duration shifts as borrower behavior changes

Why traders should care:

MBS depend on predictable cash flows. If homeowners pay normally, the bond behaves normally. But if mortgage structures change — especially with extremely long terms — payment timing becomes less predictable.

You don’t need to trade MBS to be impacted by them.

MBS make up one of the largest fixed-income markets in the world — over $11 trillion. Understanding MBS is understanding where hidden pressure points in the market can build — long before they show up in price action.

Foreclosures Tick Up

A fresh data point suggests early stress building beneath the surface.

Foreclosure filings jumped nearly 20% YoY in October, according to ATTOM — roughly 37,000 properties entering default, auction, or repossession.

What’s driving it?

• Mortgages above 7% that borrowers expected to refinance

• Rising homeowners-insurance premiums across multiple states

• Higher property taxes pushing up fixed costs

Individually, manageable. Together, they’re straining budgets just as price growth cools — reducing the equity cushion homeowners rely on.

Not a crisis - but a clear signal that affordability stress is rising.

Drop your story in the comments here.