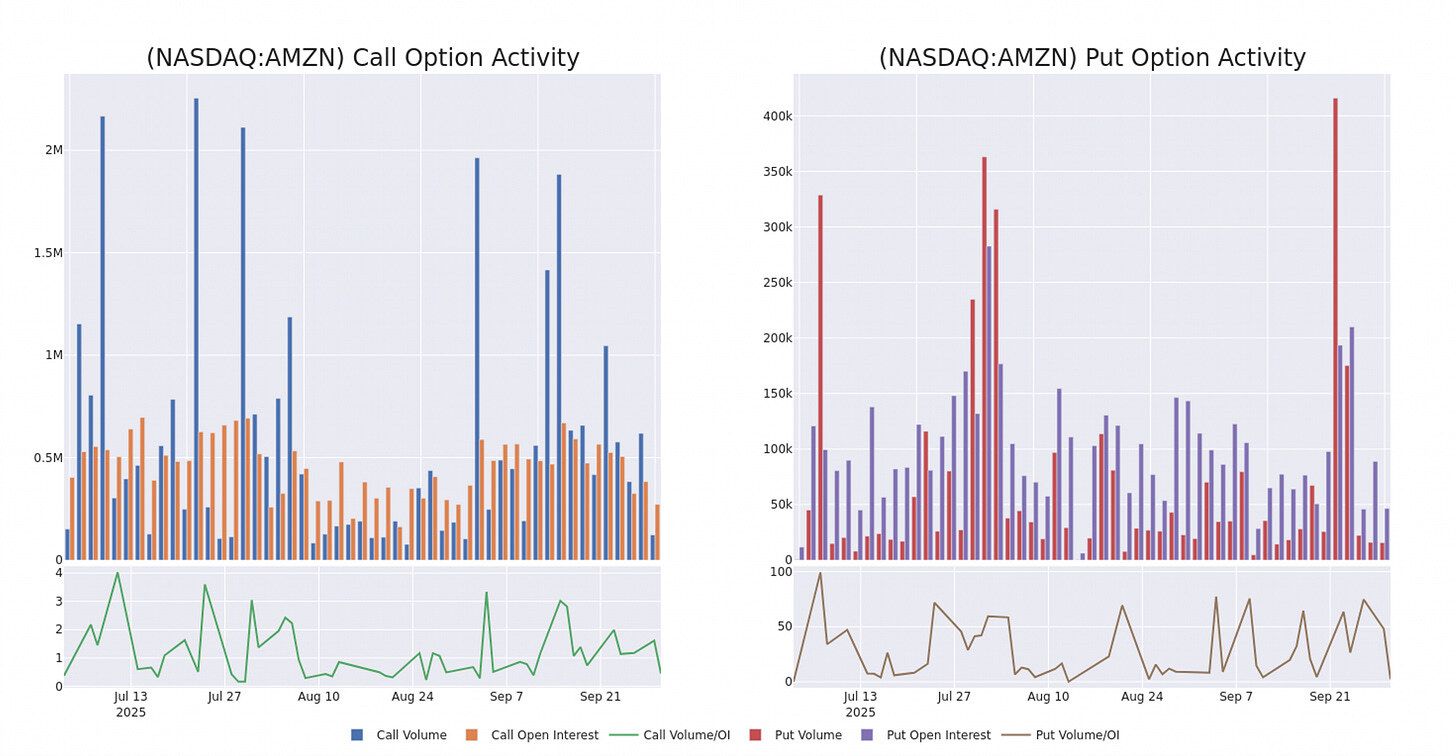

Amazon’s options board lit up with 51 large trades flagged by scanners — an unusually heavy day for AMZN flow.

The split? Calls outpaced puts, but the mood wasn’t one-sided. Some whales are leaning bullish, others are clearly hedging downside. The tape says conviction is building — but direction is still contested.

What Happened:

→ 51 unusual option trades hit the tape today — well above normal activity.

→ Notional flow: $1.99M in calls vs $1.08M in puts.

→ Positioning skew: 39% bullish, 41% bearish.

→ Key strikes ranged from $120 to $310, suggesting whales are bracketing wide territory.

Notable trades:

Nov ’25 $190 put sweep (~$2.2M notional)

Jan ’26 $260 call sweep (~$3.8M notional)

Oct ’25 $220 call block (~$4.2M notional)

At the time of publication, AMZN was trading near $219, down about 1.4% on roughly 14M shares exchanged.

The Setup:

The split flow makes AMZN a battleground. Calls dominate in count and notional size, but the presence of large put sweeps shows funds aren’t chasing blindly — they’re hedging.

That sets up a tape where:

→ Bulls see upside toward $250–$280, in line with recent analyst targets.

→ Bears anchor to $190–$200 puts as insurance against a break lower.

What Smart Traders Looked At:

→ Strike clustering: Heavy activity around $190 (puts) and $220–$260 (calls).

→ Expiration spread: Mix of near-term (Oct ’25) and long-dated (2026–2027) flows, suggesting both tactical trades and long-term bets.

→ Sentiment split: Calls slightly outweigh puts, but not enough to call it a landslide.

→ Macro lens: AMZN earnings in ~30 days — some of this flow could be positioning ahead of the report.

The Lesson:

Unusual options flow doesn’t always give a clean signal — sometimes it shows tension.

Here, the takeaway is simple:

Whales are active. Big money is positioning across multiple strikes and maturities.

Conviction is split. The flow shows both bullish speculation and protective hedging.

Watch the zones. If AMZN holds above $220, bulls may press toward $250+. A break under $200 re-validates the put side.

Bottom Line:

Amazon’s options board is flashing activity that traders can’t ignore. Calls dominate the notional size, but the hedging keeps the signal cautious.

The tape says big money is circling AMZN ahead of earnings — and whichever side gains control could set the tone into year-end.

Disclaimer

This letter is not offering investment, trading, or investment advice nor is based on any individual portfolio or business operation. We are not a registered investment, stock nor commodity advisor. One should consult with their own registered advisor to discuss investment strategies that are appropriate for their business or personal goals, risk tolerance and financial situation. Information in this report and on any website is derived from a variety of source believed to be reliable however no representation is made that the information is accurate, complete or correct. These lessons, newsletter and site content is not intended nor shall not constitute or be construed as an offer or recommendation to “buy”, “sell”, “trade” or invest in any securities, commodities, futures, options or other asset referred to in said lessons, reports or newsletters. Rather, this research is intended to identify situations and circumstances that those in the trading community should be aware of to better help assess and improve their own risk management skills.