Bitcoin just did what many doubted — printed fresh all-time highs near $125,000.

But this isn’t 2021’s parabolic chaos. The flow behind this move tells a different story: low hype, strong structure, and conviction-led capital.

The rally isn’t about excitement — it’s about discipline.

What Happened:

→ Bitcoin crossed $125,000 over the weekend, logging new record highs.

→ Market cap hit $2.45 trillion, surpassing Amazon and trailing only a few global assets.

→ ETF inflows surged, led by iShares Bitcoin (IBIT) and ARK 21Shares (ARKB).

→ Exchange balances fell to six-year lows — fewer coins available to sell.

→ Hash rate reached record levels, showing miners expanding capacity despite costs.

→ Yet, Google search interest for “Bitcoin” remains near five-year lows.

That’s the setup traders didn’t expect: new highs with no hype.

The Setup:

This breakout isn’t fueled by retail euphoria — it’s built on structure.

Supply is tightening, institutional demand is rising, and miner investment signals confidence.

This combination flips the typical playbook:

In 2021, sentiment drove Bitcoin higher until supply caught up.

In 2025, structure is driving it — supply is shrinking while conviction strengthens.

The takeaway? When capital moves with structure, the rally has legs.

This time, capital is coming from desks, not Discords.

Structure vs Speculation:

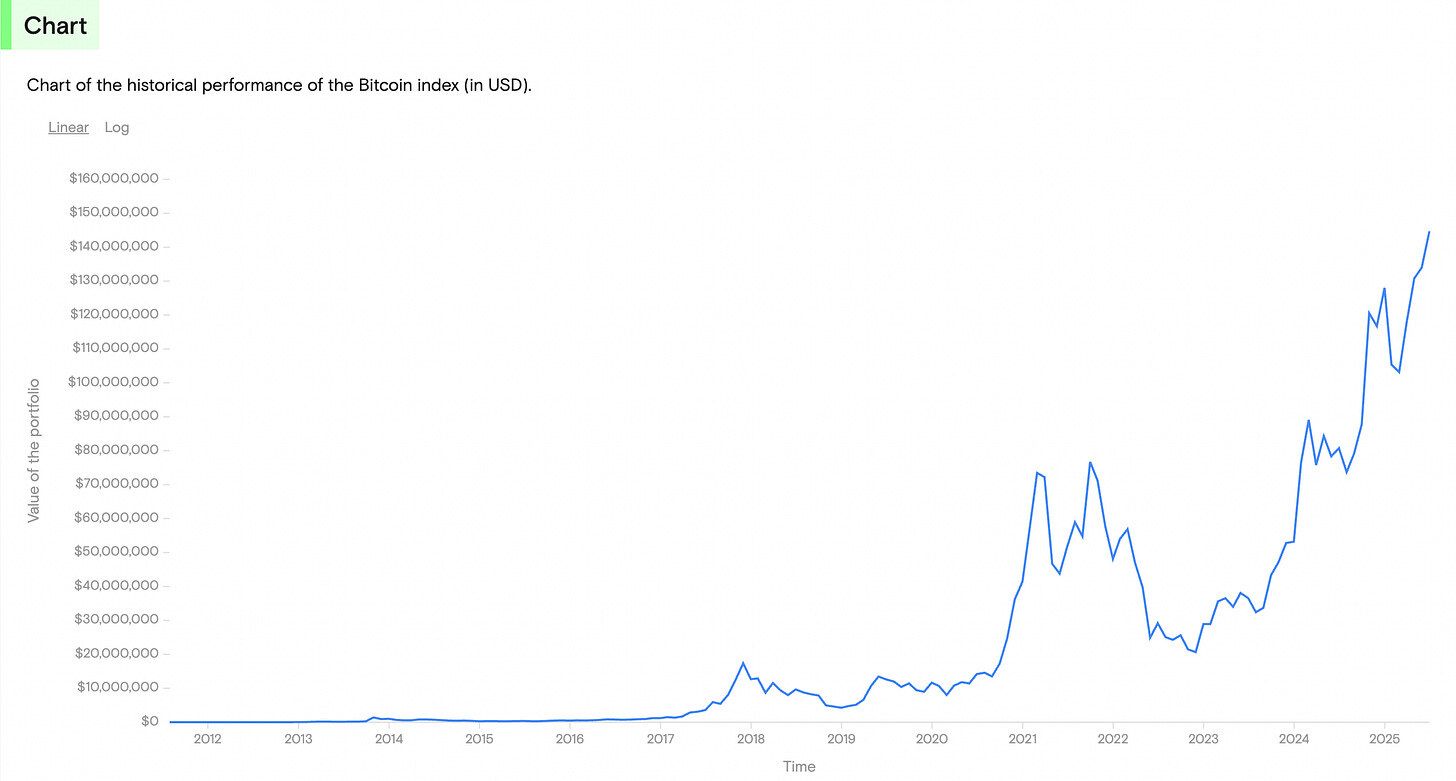

What it shows: Bitcoin’s long-term returns + market cap comparison + seasonal strength.

1\ Market Cap Comparison

2\ Long-term returns

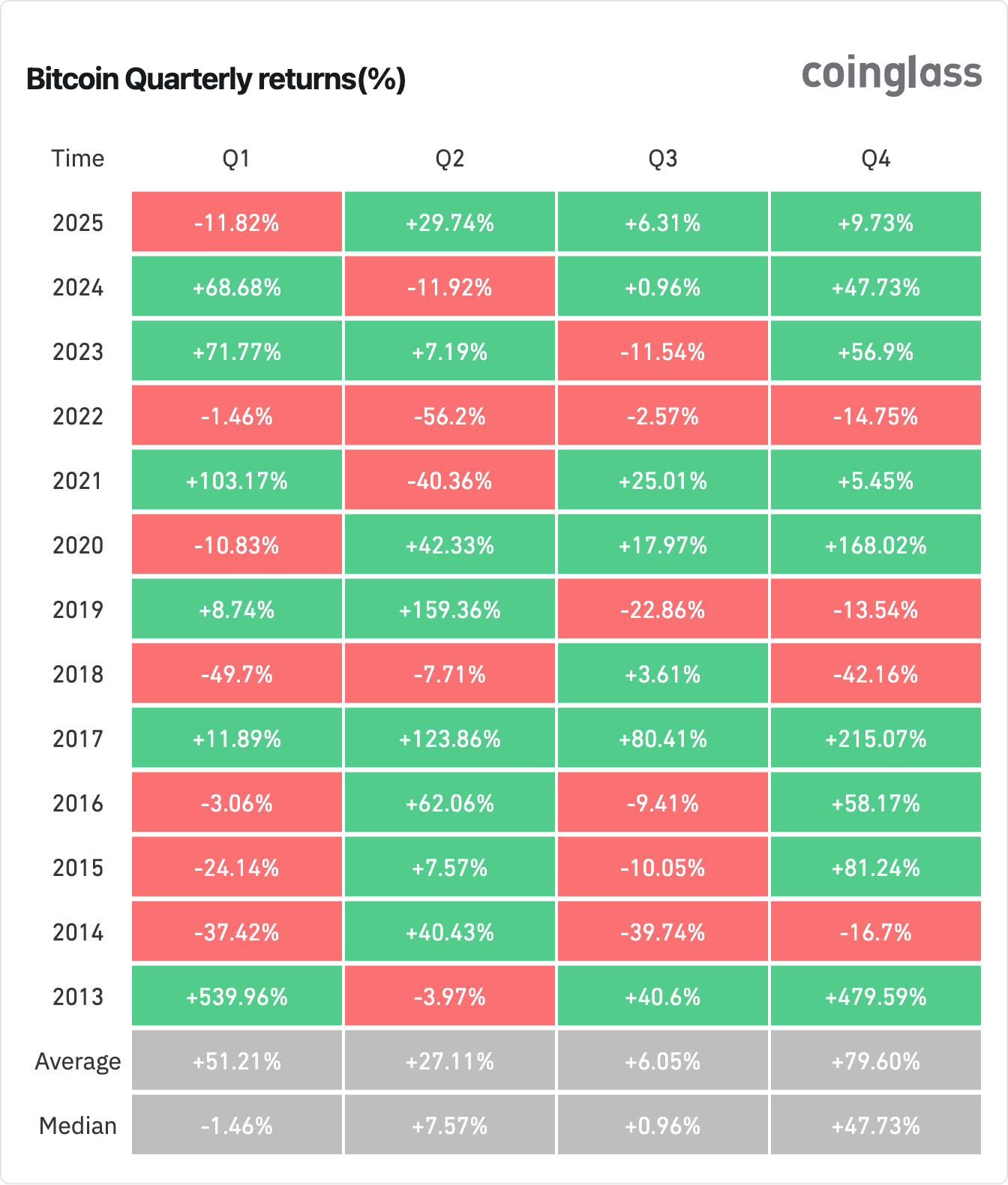

3\ Seasonality (“Uptober”)- Average returns by month

Supply & Confidence:

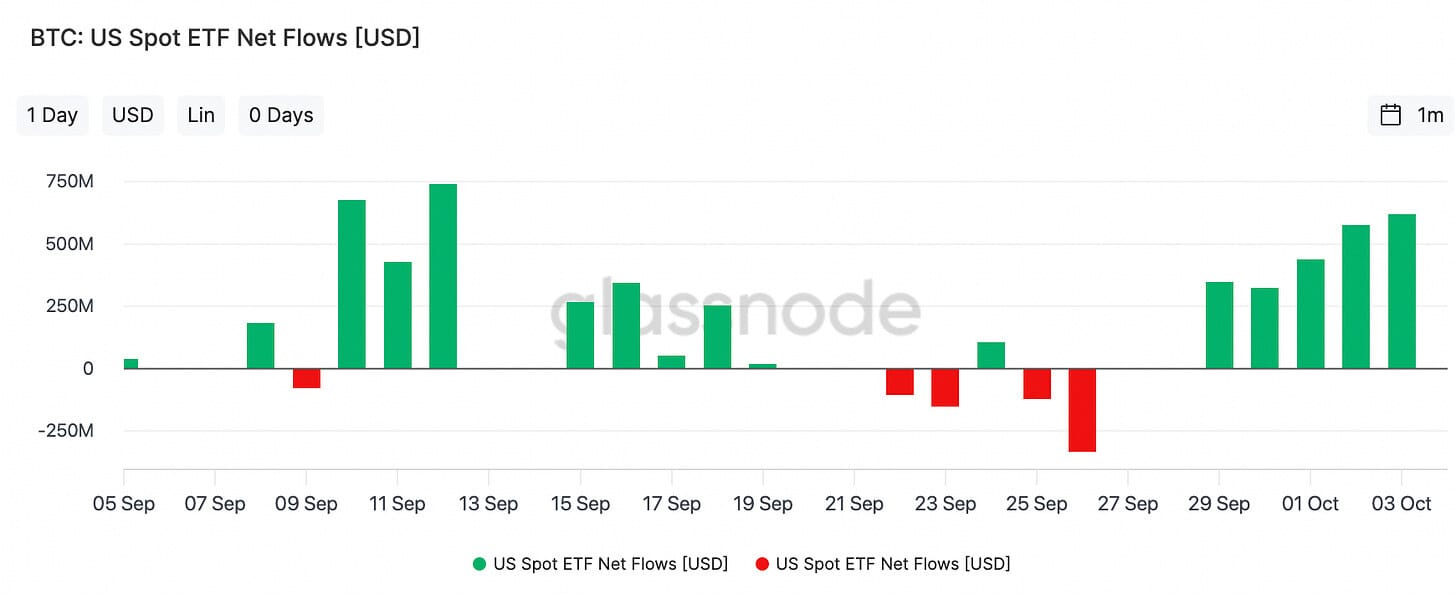

What it shows: Supply tightens, confidence climbs.

1\ Big money’s back. After a brief pullback, ETF inflows are rising again

2\ Miners are all-in. As hash rate climbs to record highs, it signals rising confidence and heavy reinvestment in mining infrastructure.

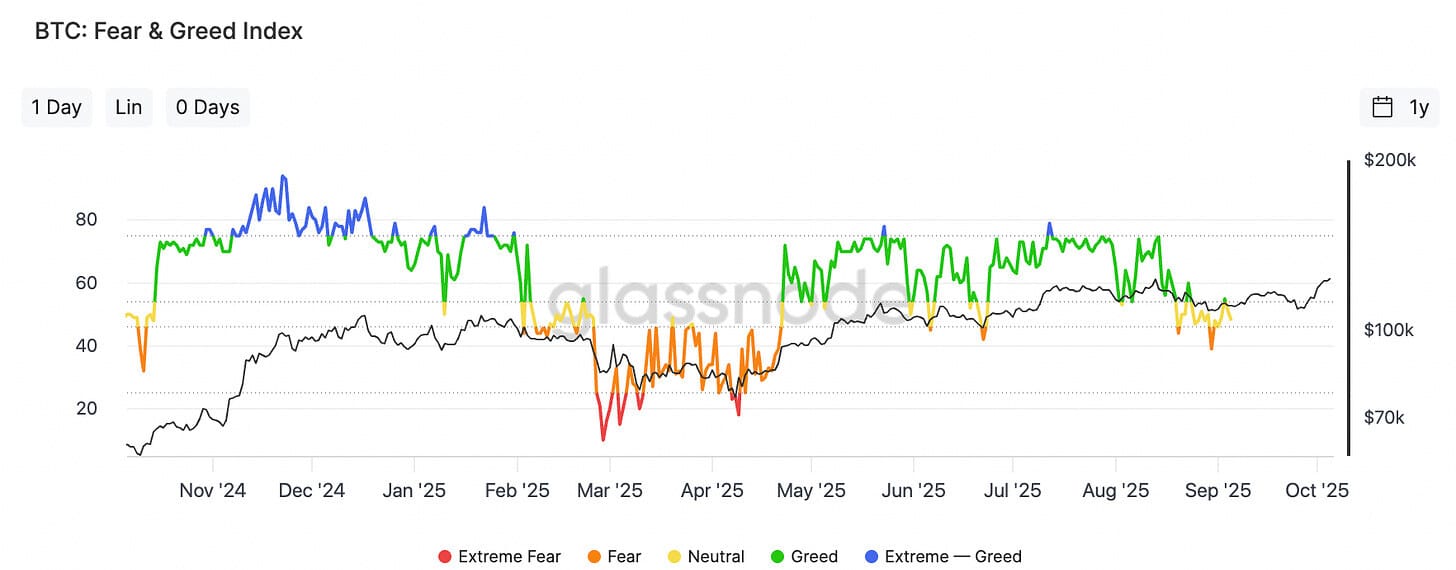

2\ The market’s confident, not euphoric. After months of “fear” in early 2025, sentiment has shifted back to steady greed.

❗What Traders Looked At:

BTC Snapshot:

Breakout Level: $122,400

Next Resistance: $134,000

Support Zone: $115,000–$118,000

Catalyst Type: ETF inflows + supply contraction

1\ ETF Flow: IBIT turnover +89% vs. 50-day average — institutional conviction confirmed.

2\ Seasonality: October and November have historically delivered the strongest average BTC returns.

3\ Supply Mechanics: Exchange holdings continue to decline, raising potential for a supply shock.

4\ Hash Rate Strength: Miner investment points to confidence in price stability, not speculation.

5\ Sentiment Divergence: Highs without hype — a contrarian bullish tell.

Technically, Bitcoin’s next resistance zone sits near $134K, a Fibonacci extension target derived from the recent breakout structure.

The Lesson:

This rally shows why structure beats excitement every time.

Conviction-led flows → ETFs, institutional accumulation, declining exchange balances → create durability.

Emotion-led flows → retail spikes, hype cycles → create fragility.

Bitcoin’s new highs remind traders that lasting breakouts don’t always come with noise.

They come when positioning, liquidity, and confidence align quietly.

Bottom Line:

Bitcoin’s $125K move isn’t a melt-up — it’s a measured breakout built on conviction.

ETF inflows, miner investment, and low-sentiment structure suggest the rally’s undercurrent is stronger than the chatter.

For traders, this is the pattern to watch:

→ when the tape runs quiet but flow runs deep — that’s where strength hides.

Disclaimer

This letter is not offering investment, trading, or investment advice nor is based on any individual portfolio or business operation. We are not a registered investment, stock nor commodity advisor. One should consult with their own registered advisor to discuss investment strategies that are appropriate for their business or personal goals, risk tolerance and financial situation. Information in this report and on any website is derived from a variety of source believed to be reliable however no representation is made that the information is accurate, complete or correct. These lessons, newsletter and site content is not intended nor shall not constitute or be construed as an offer or recommendation to “buy”, “sell”, “trade” or invest in any securities, commodities, futures, options or other asset referred to in said lessons, reports or newsletters. Rather, this research is intended to identify situations and circumstances that those in the trading community should be aware of to better help assess and improve their own risk management skills.