Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Bitcoin’s slide turned into a two-day reckoning.

After $1.4 billion in crypto positions were liquidated Monday — including $391 million in BTC longs — the sell-off deepened Tuesday as Bitcoin twice fell below $100,000 for the first time since June. ETF redemptions haven’t helped: outflows totaled $186.5 million Monday and another $763 million since, per SoSoValue.

CoinMarketCap’s Fear & Greed Index has plunged to 20, its lowest since April — firmly in “extreme fear.” Traders call it “an almost biblical level of dread.”

By Wednesday, Bitcoin clawed back above $103K, but the tone remains fragile. Galaxy Digital’s Alex Thorn now sees the year ending near $120K, down from $185K, citing “heavy whale distribution” and a rotation into competing narratives like AI, gold, and stablecoins.

The Breakdown

Analysts tie the drop to waning ETF demand, risk-off macro sentiment, and forced deleveraging across crypto treasuries.

Technically, the damage runs deep:

Below both the 200-day and 365-day MAs (~$102K) — critical supports from prior bull cycles.

Citi and CryptoQuant warn a sustained break here could replay the 2022 bear-market trigger.

Blockhead Research flags $98K as structural support; below $95K could “trigger panic.”

Prediction-market data show a 74% chance Bitcoin ends 2025 below $100K, with a 17% chance of dipping under $80K.

Thorn sees short-term upside capped: “Nearing prior all-time highs before year-end is reasonable for short-term bulls,” he wrote — but cautioned that gains could come slower as cyclical headwinds persist.

Still, others call this a reset, not a collapse. FG Nexus’s Maja Vujinovic said holding $100K–$105K could mark a “healthy reset.” Coin Bureau’s Nic Puckrin remains long-term bullish, eyeing $150K once fear clears.

sponsored:

President Trump Just Privatized The U.S. Dollar

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on November 18 if you want to profit.

Go here for details now — while you still have time to position yourself.

Trading Through Fear

Extreme fear isn’t a signal to predict — it’s a signal to observe.

At psychological levels ($100K, $95K, $90K), price reflects human stress as much as market value.

Disciplined traders:

① Use higher-time-frame context — short-term breaks don’t define full cycles.

② Wait for confirmation — capitulation first, reversal later.

③ Watch liquidity spikes — forced selling often precedes relief rallies.

④ Detach execution from emotion — alarms beat adrenaline.

Fear sells, but patience profits.

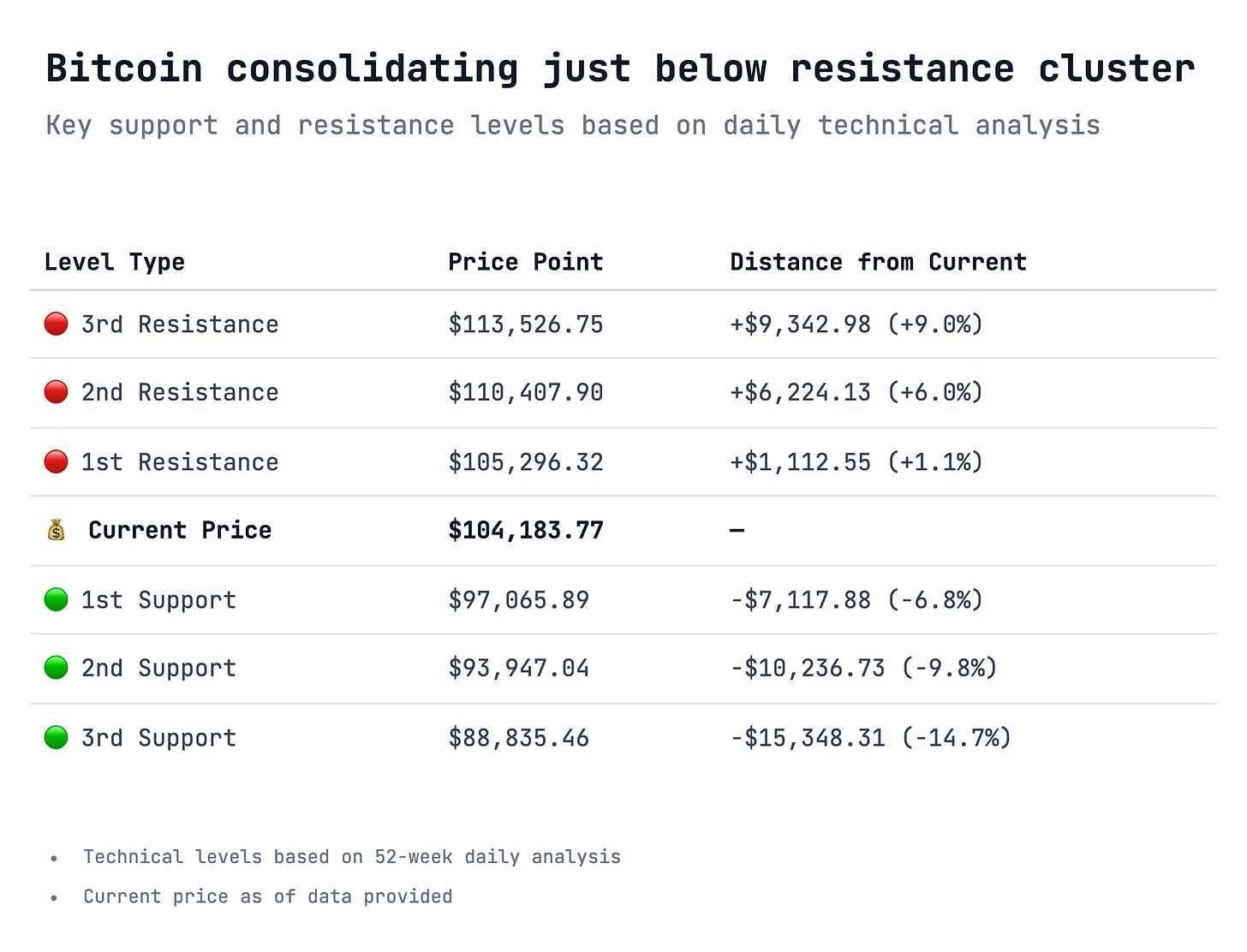

What the Chart Shows

Lesson of the Day: Backtesting — The Trader’s Truth Serum

Every trader has thought it: “If I’d just followed that setup every time, I’d be up big.”

Backtesting is how you find out if that setup actually works — or if it just looked good in hindsight.

It’s not about predicting the future; it’s about pressure-testing your strategy under different market conditions to see if the edge holds.

Done right, backtesting reveals three things:

Profitability: Does your edge actually exist?

Risk: How deep are the drawdowns, and can you stomach them?

Consistency: Does it hold up across bull, bear, and sideways markets?

Most traders avoid backtesting because it forces them to face uncomfortable truths. But that’s exactly what makes it powerful — it exposes weaknesses before the market does.

If your backtest looks flawless, it’s probably overfitted. If it looks realistic, you’ve found something valuable.

Backtesting won’t make you right on every trade — it’ll make you honest about what’s working.

Key levels:

Share Your Lesson:

Have you traded through a panic cycle before?

Share how you recognized when fear turned into opportunity.

Drop it in the comments here.