Looking for the Poll of the Day? Scroll down to find it 👇

This week Bitcoin and Ethereum have spent Q4 bouncing between sharp rallies and sudden selloffs. What’s driving these extreme moves? Massive leverage concentrated at specific price zones. If price tags one of these zones, it can set off a wave of forced liquidations.

When a leveraged trade blows through its margin, the exchange doesn’t ask — it auto-sells (or auto-buys) to close the position. If thousands of traders are sitting at the same level, it becomes a cascade that moves the entire market.

And that’s the part most spot traders miss:

These liquidation clusters behave like landmines. Price doesn’t need bad news — it just needs to step on the wrong level, and the chain reaction does the rest.

So right now, Bitcoin and Ethereum are being steered less by sentiment… and more by these leverage clusters.

Three price zones.

Billions at stake.

And a market that remains one sharp move away from an air pocket.

Let’s break down where the real stress sits.

PRESSURE POINTS

The Liquidation Lines

While spot traders argue over bottoms and reversals, the derivatives market is offering something far more concrete: a map of where forced buying and forced selling will kick in if prices keep moving.

Think of these liquidation zones as pressure shelves:

Below spot: clusters of long liquidations (forced selling)

Above spot: clusters of short liquidations (forced buying)

Once price enters one of these shelves, exchanges don’t negotiate — they automatically close positions. That flood of buy or sell orders can accelerate the move and spill directly into spot markets.

These aren’t predictions.

They’re mechanical triggers.

And together, they show exactly where the real stress sits under BTC and ETH right now.

Presented by Masterworks

$57 Billion in NVDA Revenue, 62% YoY Growth. And stocks still fell… What now?

Nvidia just posted a record-breaking quarter… yet the markets dropped. Why?

Experts say that even the top AI earnings couldn’t calm the fear of a potential bubble.

After soaring at the open, the S&P reversed sharply, wiping out over $2T of value in hours.

The “Great Bitcoin Crash of 2025” only wiped out ~$1T by comparison.

Wall Street’s finally asking: What if AI isn’t enough?

So, where can investors diversify when public markets stop making sense?

Now, for members-only → blue-chip art.

It’s not just for billionaires to tie the room together. It’s poised to rebound.

With Masterworks, +70k are investing in shares of multimillion dollar artworks featuring legends like Basquiat and Banksy.

And they’re not just buying. They’re selling too. Masterworks has exited 25 investments so far, including two this month, yielding net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers skip the waitlist:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

BITCOIN:THE TRAPS BELOW

Shorts aren’t any safer:

• $94,354 → 1,640 BTC liquidated ($142.4M)

• $95,123 → 3,200 BTC liquidated ($277.9M)

• $98,356 → 3,920 BTC liquidated ($340.5M)

• $112,005 → 6,460 BTC liquidated ($561M)

• $114,295 → 7,080 BTC liquidated ($615M)

Once BTC lifts above ~$95K, the liquidation curve steepens — but the real eruption sits near $112K–$114K, where the short side becomes a bonfire.

If BTC rallies, traders are already pricing in something bigger than a retest of $100K — they’re positioning for six figures.

BITCOIN: THE TRAPS ABOVE

If BTC keeps sliding, the pain points stack up fast:

• $78,617 → 1,880 BTC liquidated ($163.3M)

• $73,557 → 3,500 BTC liquidated ($304M)

• $63,875 → 5,630 BTC liquidated ($489M)

When thousands of leveraged longs share the same liquidation price, you don’t get a normal selloff. You get a chain reaction — forced selling that forces more selling.

And traders know it: put open interest is heaviest right in the $80K–$75K range, showing where the market is hedging hardest.

ETHEREUM: WHERE THE BOARD TILTS

For ETH longs, the biggest cluster is sitting right below support:

• $2,327 → 113,180 ETH liquidated ($328.7M)

That’s the level nobody wants to see tested.

It’s where the board tilts.

For shorts:

• $3,976 → 80,390 ETH liquidated ($233.4M)

ETH doesn’t need a parabolic run to squeeze the market — it just needs to poke above $3,900.

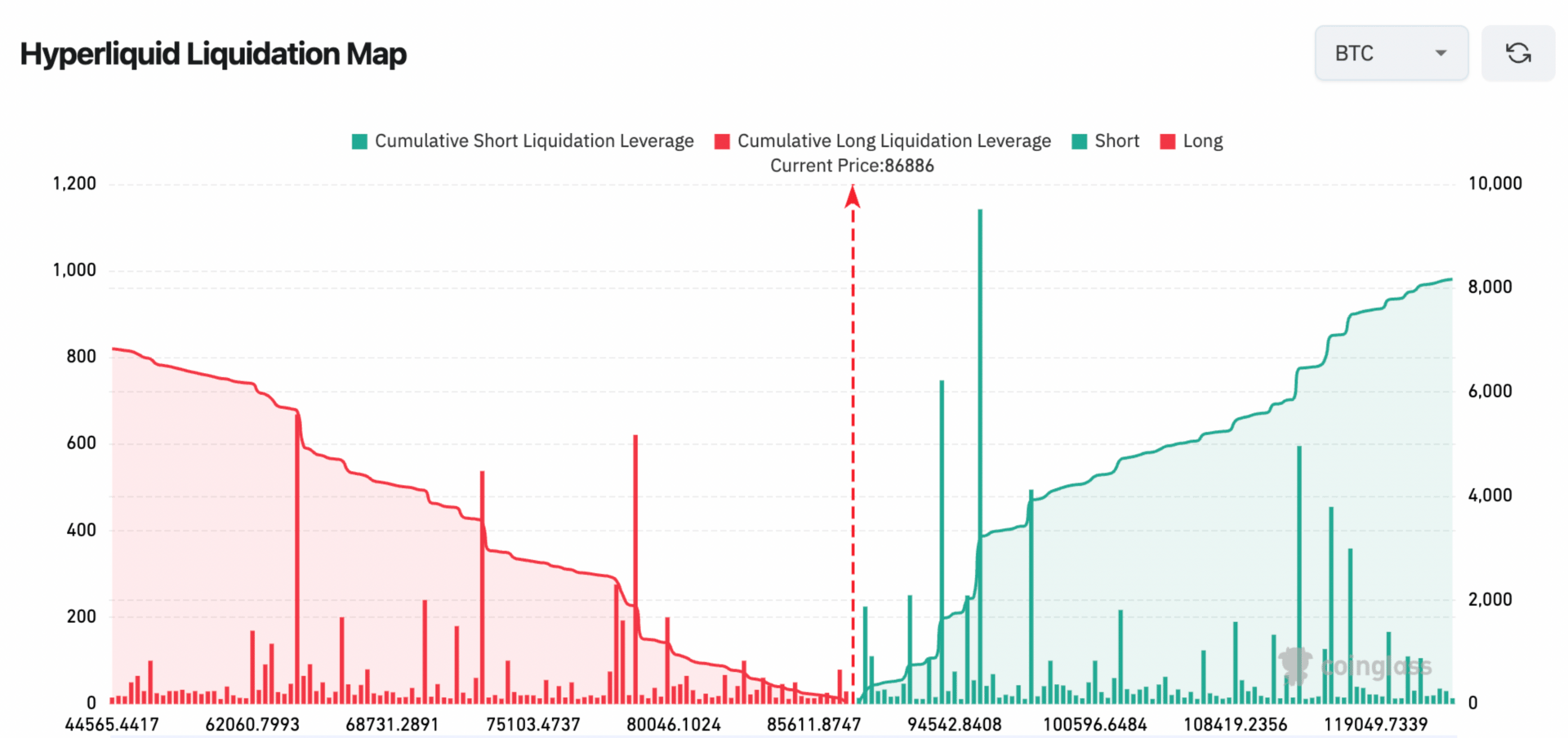

WHAT THE CHART SHOWS

These charts show where the biggest leverage pockets sit for Bitcoin and Ethereum — and where forced liquidations will hit if price moves into those zones.

Red = long liquidations: price drops here → exchanges auto-sell.

Green = short liquidations: price rises here → exchanges auto-buy.

Here’s what stands out:

BTC

$78K–$75K: major long-liq cluster — a dip into this zone could trigger heavy forced selling.

$94K–$110K: stacked short-liq pockets — any breakout could snowball into a rapid short squeeze.

ETH

$2,300–$2,400: biggest long-liq wall — the highest-risk downside zone.

$3,900–$4,000: dense short-liq shelf — a rally here could trigger forced buying.

(Coinglass, Sherwood)

Liquidation clusters act like pressure points: once hit, exchanges automatically fire buy/sell orders. That mechanical flow can turn a normal move into a cascade — which is why BTC and ETH have been swinging so violently.

In short: sentiment isn’t steering the market right now.

Leverage is.

THE TAKEAWAY

These levels aren’t just numbers on Hyperliquid.

They’re a proxy for leverage across the entire market — including centralized exchanges that don’t publish their liquidation bands at all.

When one venue flushes billions in leveraged positions, the forced buying and selling spills everywhere:

spot, futures, altcoins, liquidity pools — all of it

THE TRIGGERS

A drop toward $75K or a rally toward $95K won’t just move charts…

they’ll trigger liquidation clusters big enough to set the tone for the whole market.

October’s record liquidation day proved it.

One 24-hour wipeout reshaped the entire month.

BTC near $75K?

Expect cascading liquidations, fast.

BTC near $95K?

Expect the opposite — forced buying that accelerates the move.

ETH near $2,300?

That’s the stress zone.

ETH near $4,000?

That’s the squeeze zone.

One market.

Two flows.

Billions waiting for a trigger.

LESSON OF THE DAY:

Risk management is the foundation of every real trading strategy — the part that protects your capital before you go hunting for returns.

Risk management = understanding both sides of a trade: the potential downside and the potential reward.

Balancing risk vs. reward is non-negotiable — every decision sits somewhere on that scale.

Traders use different risk strategies:

Avoidance (skip the bad setups)

Retention (accept manageable risk)

Sharing (hedging with others)

Transferring (insurance, stop-losses)

Loss prevention & reduction (position sizing, diversification)

One of the simplest ways to measure risk is through standard deviation — a statistical way to see how volatile an asset is relative to its average.

Bottom line:

Good trades make money.

Great risk management lets you keep it.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Don’t forget to cast your vote 👇