When conviction meets flows, markets soar. When leverage meets emotion, accounts get wiped.

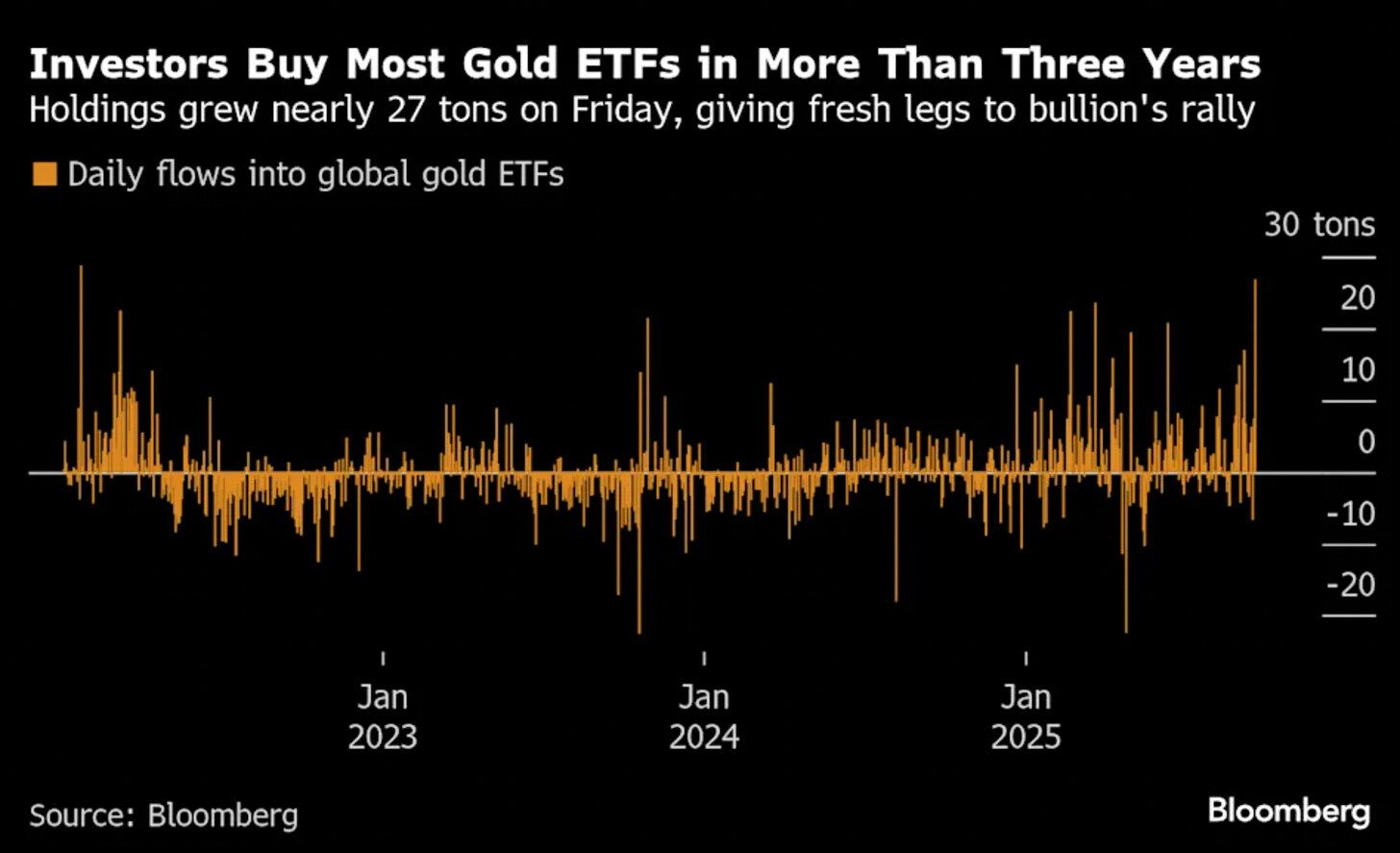

Gold opened the week at fresh records, climbing past $3,760 as ETF inflows hit a three-year high. Silver joined the run, topping $44 with year-to-date gains over 50%.

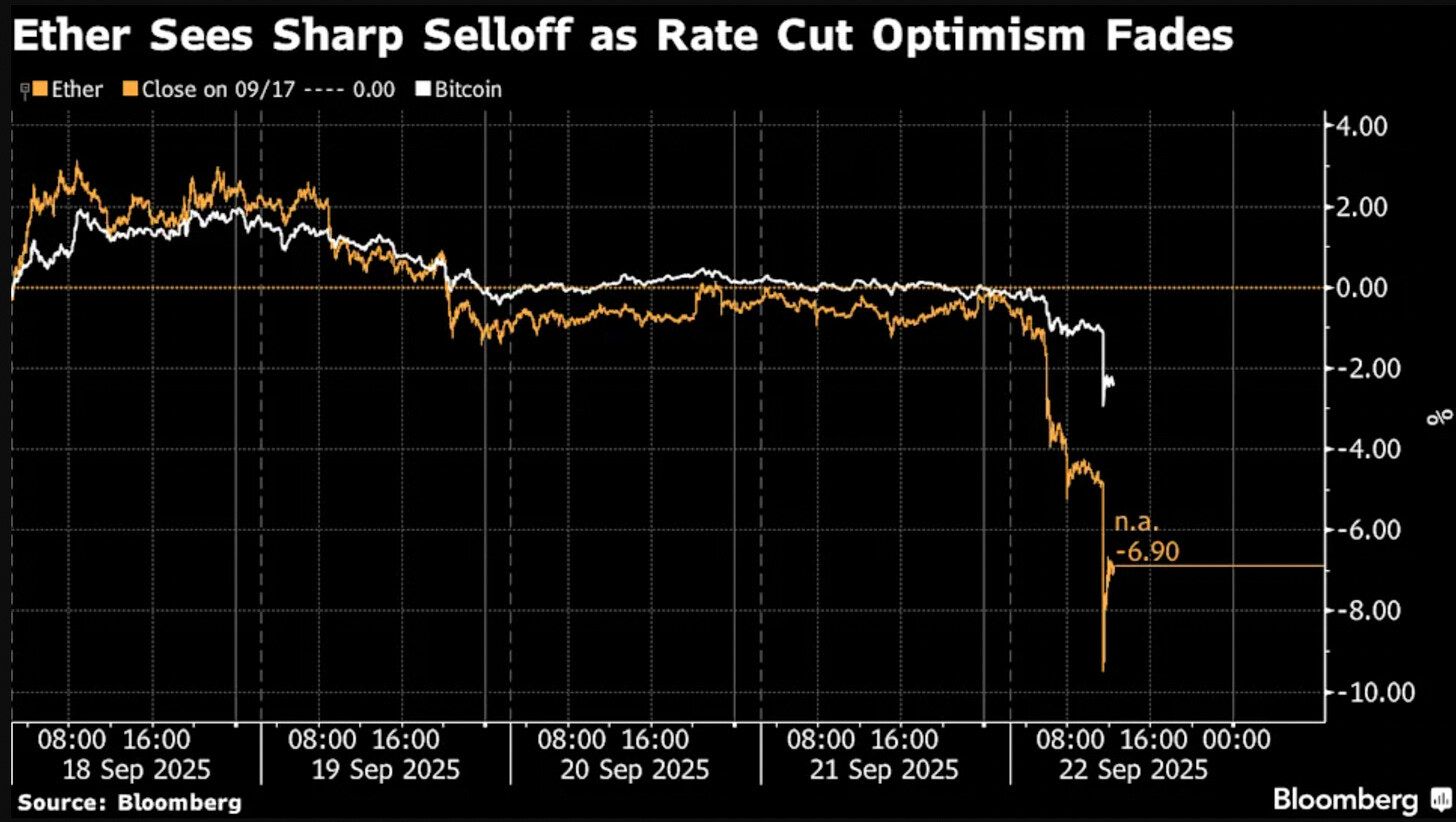

At the same time, crypto traders were hit with one of the largest liquidation waves of the year — $1.5B in bullish bets wiped as Ether dropped 9% and Bitcoin slipped toward $112K.

So what’s really driving the tape: conviction flows… or unchecked greed?

What Happened:

Gold & Silver

→ Gold spiked above $3,760 in the week’s opening session, logging a fifth straight weekly gain.

→ Bullion-backed ETFs rose 0.9% on Friday, the sharpest inflow since 2022.

→ Silver broke through $43 resistance, advancing to $44 on bullish momentum.

→ Drivers: Fed’s rate cuts, central-bank reserve buying, and geopolitical tension fueling safe-haven demand.

Crypto:

→ Over $1.5B in leveraged long positions were liquidated Monday.

→ Ether plunged 9% intraday, while Bitcoin dropped 3% to $111,998 before stabilizing.

→ Altcoins including Solana, Algorand, and Avalanche fell 5–8%.

→ More than 407,000 traders were liquidated in 24 hours — the deepest purge since March.

→ Market depth thinned: unless BTC reclaims $115K, downside risks remain.

The Setup:

The contrast between gold and crypto shows two very different types of flows:

Metals rally on conviction. Fed easing, ETF demand, and central-bank buying are structural drivers. Flows create staying power. That’s sticky capital, not hot money.

Crypto sells off on fragility. Over-leveraged longs chasing momentum. When sentiment cracked, stops cascaded into one of the biggest purges of the year.

That puts traders in a dual setup:

→ Metals: conviction-led momentum could extend toward $4,000 gold and $50 silver — but overbought risk signals consolidation is likely before the next leg.

→ Crypto: positioning remains vulnerable. Without BTC back above $115K, rallies risk fading into further liquidation cascades.

For traders, it frames a simple test:

→ Are you trading conviction or emotion?

→ Is the move backed by flows, or just leverage waiting to unwind?

What Smart Traders Looked At:

Gold/Silver:

→ ETF inflows = conviction signal, not speculation

→ Break levels: $3,708 in gold and $43 in silver cleared cleanly

→ Overbought conditions raise risk of consolidation before the next leg

→ Macro watch: PCE inflation data this week could justify deeper cuts

Crypto:

→ Liquidation depth — $1.5B wiped signals leverage unwinding, not structural failure.

→ Funding rates — ETH perp futures turned negative, shorts paying longs = bearish bias.

→ Options flow — heavy skew toward puts post-liquidation, reflecting shaken sentiment.

The Lesson:

This is greed vs. conviction in real time.

1) Conviction flows (like ETF demand in gold) build sustainable momentum.

2) Greed-driven leverage (like crowded longs in crypto) builds fragility.

Both create opportunities — but the setups couldn’t be more different.

Gold rallied because capital flowed in with structure — ETF demand, central-bank buying, macro support.

Crypto collapsed because leverage piled up on emotion — traders chasing upside until the market forced an exit.

The key takeaway: flows matter more than hype.

Conviction builds trends. Greed fuels liquidations.

Here’s how pros parse it:

→ Separate conviction from emotion — gold rallies on structural demand, crypto fell on greed.

→ Manage risk first — conviction can carry trends, but stretched tape often consolidates before the next move.

Bottom Line:

Both moves remind traders of a core truth: it’s not about what’s moving, but why.

Capital flowing in with structure sustains rallies. Leverage without support only fuels liquidations.

The market will test both again soon: $4,000 gold and $50 silver are now in sight, while crypto traders ask if $115K Bitcoin is make-or-break.