Don’t forget to cast your vote 👇

So… Robotaxis Are Finally Here?

Tesla confirmed over the weekend that it is testing Robotaxis in Austin without safety monitors in the vehicle.

On the surface, this wasn’t new. Tesla has talked about unsupervised autonomy, Robotaxis, and Full Self-Driving for years. By the book, another testing update shouldn’t have changed much.

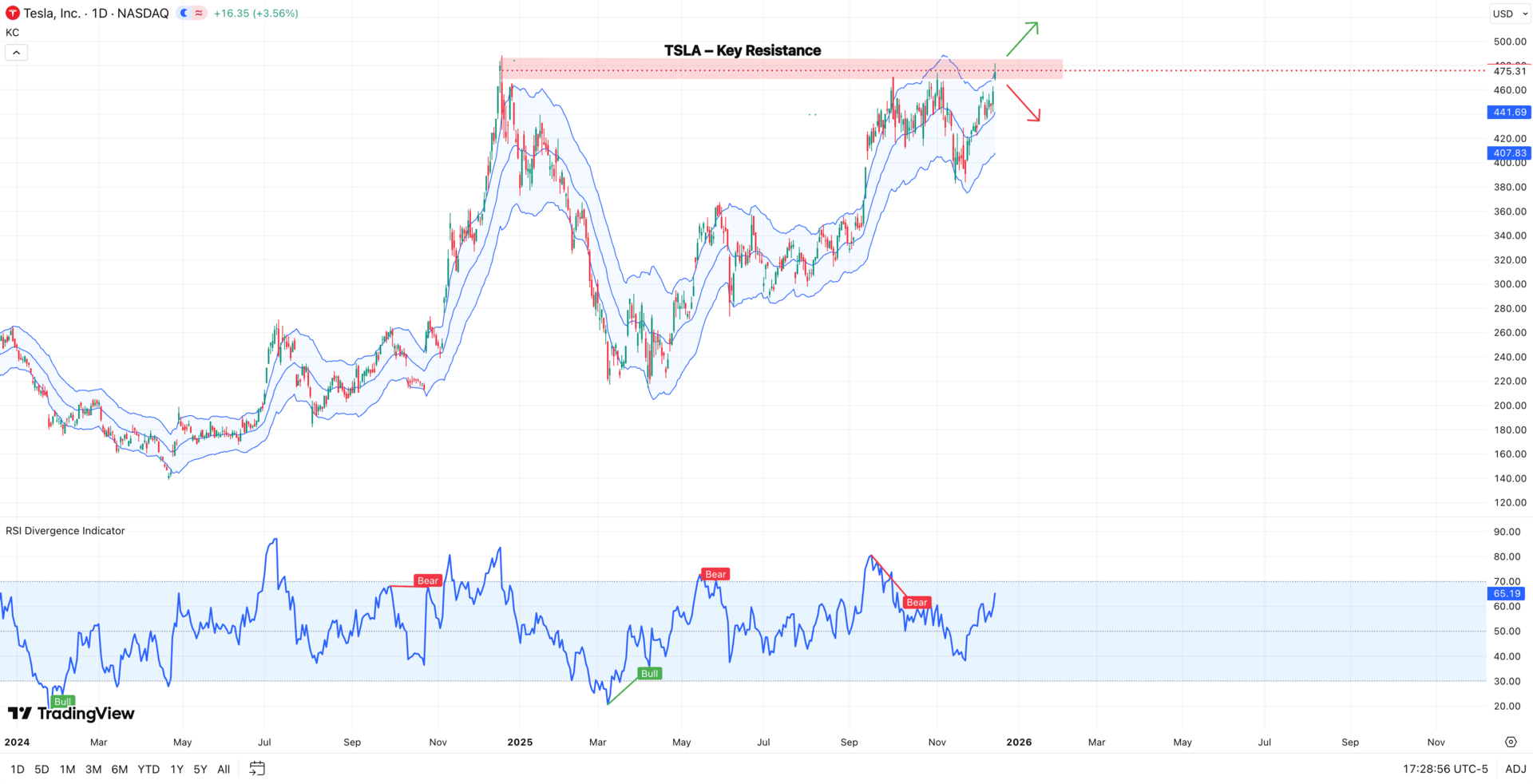

Instead, $TSLA jumped ~4%, pushing toward its highs.

Uber and Lyft sold off hard.

Waymo names wobbled.

So what did the market actually reprice?

Traders didn’t react to new promises.

Not revenue.

Not market share.

But probability. It was the execution risk coming out of the equation. Markets were repricing the probability that Tesla can deploy it.

Let’s break down why.

THE BREAKDOWN:

1) The Test That Crossed the Line

Tesla has talked autonomy for years. The market has heard it all before.

What changed this time: execution crossed a line.

→ Robotaxis operating with no safety driver

→ Testing aligned with management’s stated timeline

→ Confirmation came from Musk, not leaks

This wasn’t a concept video. It was execution — real roads, real footage, real progress.

For traders, direction beats perfection.

And Tesla’s direction just turned tangible.

2) Dan Ives Pushed the Narrative — Hard

Wedbush’s Dan Ives didn’t hold back:

→ Robotaxi expansion to 30+ U.S. cities

→ Cybercab volume production starting April/May

→ FSD penetration rising from 12% → 50%+

→ Tesla controlling ~70% of global autonomous market (his view)

→ $600 price target reiterated

→ Bull case: $800 in 12–18 months

→ Valuation path: $2T next year, $3T by 2026

Aggressive? Yes.

New? Not really.

But paired with real-world driverless testing, the story gained credibility.

3) Why Uber and Lyft Sold Off

This wasn’t about today’s revenue. It was about future margin risk.

If Tesla proves autonomy at scale:

→ Ride-hailing economics change

→ Cost-per-mile collapses

→ Platform leverage shifts from networks to hardware + AI

Uber and Lyft trade on human labor economics.

Tesla trades on software scaling economics.

The tape reflected that distinction immediately.

4) The Regulatory Angle Matters — But Later

Ives expects easing federal oversight and reduced state-level friction around autonomy, possibly via executive action in 2026.

That’s not priced as certainty. It’s priced as optional upside.

Key point:

Tesla rallied because progress made regulation more relevant.

Execution first. Policy later.

5) The Valuation Paradox

Here’s the part the market hasn’t forgotten:

→ Most of Tesla’s revenue still comes from EVs

→ Robotaxis are not monetizing at scale yet

→ Waymo still leads in paid autonomous rides

→ Regulatory and safety hurdles remain real

That’s why this wasn’t a straight-line breakout.

This move wasn’t about cash flows today.

It was about probability tomorrow.

THE TAKEAWAY:

The test pulled the autonomy timeline forward.

Driverless Robotaxi runs gave the market something concrete to price — not scale or revenue, but execution.

For a stock already priced on the promise of autonomy, small proofs of progress move valuation faster than fundamentals ever will.

Regulation, rollout, monetization — they’ll come later.

But in markets, expectations move first.

That’s what today traded.

LESSON OF THE DAY:

Lesson of the Day: Santa Claus Rally

The Santa Claus rally isn’t folklore. It’s a recurring liquidity window.

The final five trading days of December and the first two of January have delivered gains roughly 80% of the time since 1950, with the S&P 500 averaging about +1.3% over that stretch. The move itself isn’t huge — but the consistency is what keeps traders watching it.

This period tends to coincide with thinner liquidity, lighter institutional participation, and year-end positioning resets. With fewer sellers and less hedging pressure, markets often drift higher without needing fresh catalysts.

That’s why the Santa Claus rally matters less as a trade and more as a signal. It shows how the market behaves when conditions are favorable.

When stocks rise during this window, it usually confirms existing momentum and risk appetite. When they don’t — when markets struggle during a historically supportive stretch — it has often preceded more fragile conditions into the new year.

The rally doesn’t create strength.

It reveals it.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Enjoying this post?

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

❗ P.S. - If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇