Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

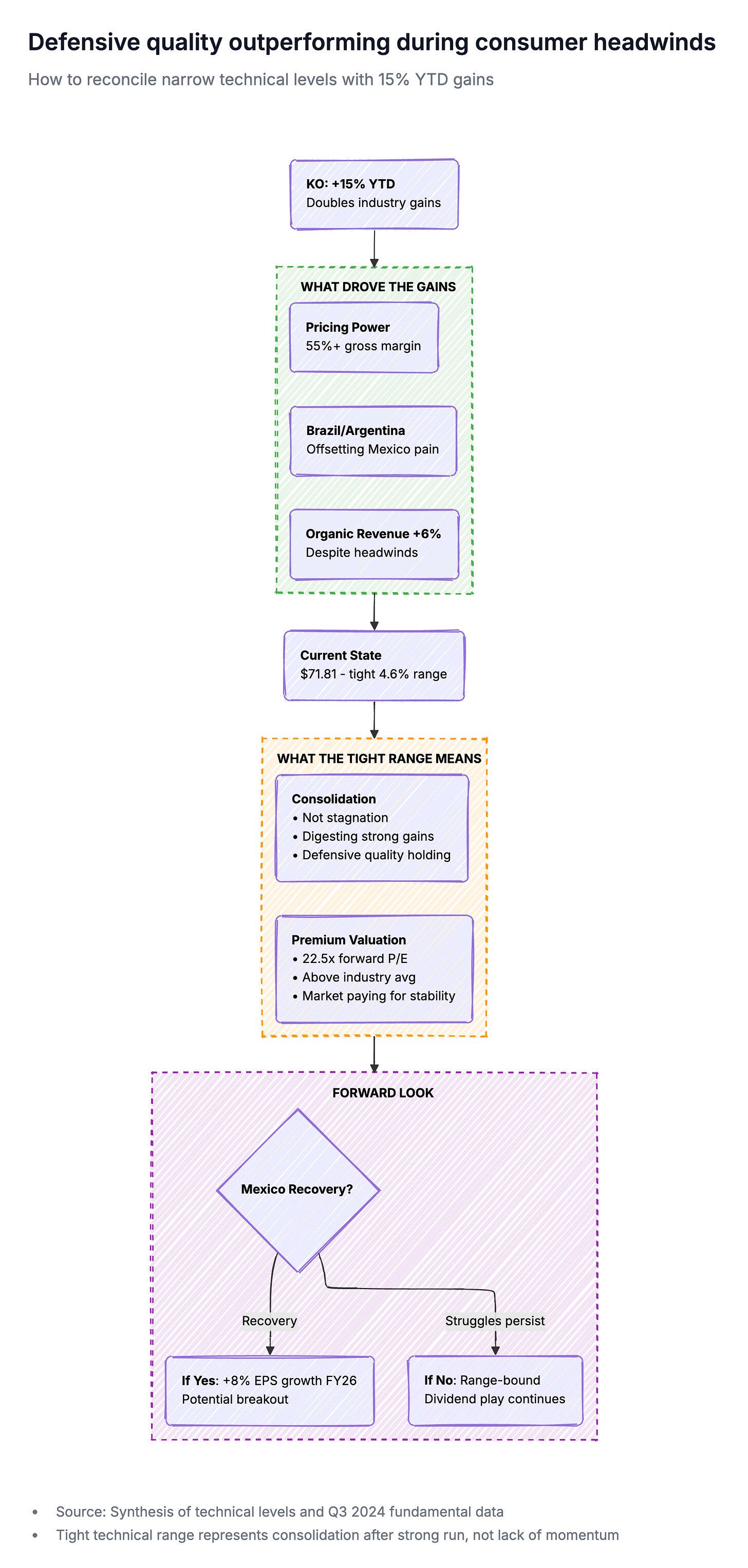

Coca-Cola’s Q3 showed both bubbles and bruises.

Organic revenue rose 6%, but Latin America — usually a growth engine — came in flat, dragged down by weak consumer demand in Mexico and currency pressure across the region. Shares are still up 15% YTD, outpacing peers, but momentum has clearly lost some carbonation.

The Trigger

Unit case volume in Latin America was flat. The decline in Trademark Coca-Cola offset growth in water, sports, and coffee categories. Concentrate sales fell 3%, and foreign-exchange headwinds shaved another 8% off regional revenue, partly balanced by 7% price/mix gains.

Mexico was the problem child, where inflation, policy tweaks (like sugar-tax changes), and cautious consumers put a cap on demand. Management says a full recovery will take time, but early signs from revenue-growth strategies and new packaging formats are encouraging.

After declining sales, Trump's threats, and a 45% stock plunge…

Tesla just roared back to positive territory.

And mark my words, this is just the beginning.

Because once Tesla's 250x AI breakthrough goes mainstream on January 29…

We're looking at a wealth creation event 14x bigger than the ChatGPT boom.

Bright Spots

Brazil and Argentina kept things fizzing. Coke Zero Sugar and refillable dual-packs in Brazil helped the brand gain value share in the non-alcoholic ready-to-drink category, while Santa Clara milk products in Mexico dominated the value-added dairy segment — showing Coca-Cola’s knack for local innovation and portfolio agility even in tough markets.

The Competition

PepsiCo is holding steady with disciplined pricing and stronger snack synergy, while Monster Beverage continues to own the energy-drink niche. Both are weathering inflation better than most consumer peers, giving Coke less room to raise prices without pushback.

By the Numbers

EPS Growth: +3.5% expected for FY2025, +8% for FY2026

Forward P/E: 22.46× vs. industry avg. 18.09×

YTD Stock Performance: +15.3% vs. industry +7.6%

6% organic revenue growth in Q3

55%+ gross margin range maintained

Valuation sits around 22.5x forward earnings, above the sector average but below the S&P 500. It’s a sign investors still see Coke as a defensive play — not a growth story.

What the Chart Shows

Lesson of the Day:

Understanding the Cup and Handle

The cup and handle is a visual narrative of market psychology: recovery, hesitation, and conviction.

Cup: Accumulation and recovery — buyers gradually absorbing supply after a pause.

Handle: Controlled pullback as traders take profits and reset positions near resistance.

How to interpret it:

The cup should form gradually, with a “U”-shaped recovery.

The handle appears as a mild downward drift in the upper half of the structure.

Volume typically falls during the handle and expands at the breakout.

Trading approach:

Wait for a close above the handle’s resistance before entry.

Set a profit target equal to the depth of the cup added to the breakout level.

Manage risk with a stop below the handle’s low.

While simple in appearance, the pattern reflects deep market behavior — patience, accumulation, and conviction returning after a pause.

Key levels:

The Complete Picture:

On Another Note: Momentum Watch

Even in a market that’s lost some steam, a few names are still charging ahead. Here’s where momentum hasn’t slowed:

Interactive Brokers (IBKR)

→ Up 40% in the past six months as traders crowd back into futures and options.

→ Analysts have raised earnings estimates +5.1% over the last 60 days.

→ The brokerage’s scale and global reach keep it ahead of the retail slowdown.

NatWest Group (NWG)

→ The UK lender has gained 9.7% in three months, defying the sector’s drag.

→ Profit expectations jumped +13.8% since September.

→ Healthy rate spreads and stable credit demand are giving it a quiet tailwind.

StoneCo (STNE)

→ Brazilian fintech comeback story — shares up 12.6% in three months.

→ Earnings estimates climbed +10.4% in the same period.

→ Expanding payments volume and easing inflation have boosted investor confidence.

Drop your story in the comments here.