Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Nvidia’s brutal week just confirmed what traders have been whispering — AI valuations are starting to look stretched.

Shares slid nearly 3% Friday, capping a 10%+ weekly loss, as investors digested fresh warnings about a potential “AI bubble.”

The Trigger

A trio of headlines was enough to shake confidence across tech this week:

Qualcomm’s “good but not great” earnings reminded investors that even solid results can’t justify sky-high expectations.

OpenAI’s CFO floated the idea of government backing for chip financing, sparking debate about just how self-sustaining the AI boom really is.

Officials quickly pushed back, saying there’s no safety net coming for the industry.

That was all it took to knock sentiment off balance.

At one point Friday, the Nasdaq was down 1.8%, pacing for its steepest weekly drop since April’s tariff shock.

Meanwhile, the University of Michigan’s sentiment index fell to 50.3 — its lowest since 2022 — and the missing jobs report (still delayed by the government shutdown) left markets flying half-blind.

In short: optimism is thinning out just as the data’s drying up.

sponsored:

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

For the full story, click here.

The Bigger Picture

Tech’s been carrying the market all year. The S&P 500 is up 35% since April, with the Magnificent Seven now accounting for nearly 40% of its total value.

Even with strong earnings from Microsoft, Meta, and Amazon, investor enthusiasm has cooled as attention shifts to what’s next for AI growth.

When valuations stretch this far, the margin for error disappears.

The Nvidia Factor

Nvidia’s next earnings (Nov. 19) could be the turning point.

Analysts expect $54.6B in revenue and $1.25 EPS, up 56% year-over-year.

If those numbers land, the rally might reignite.

If they don’t? We could be looking at a bigger unwind in the AI complex — and Nvidia’s already shaved $450B off its market cap this week alone.

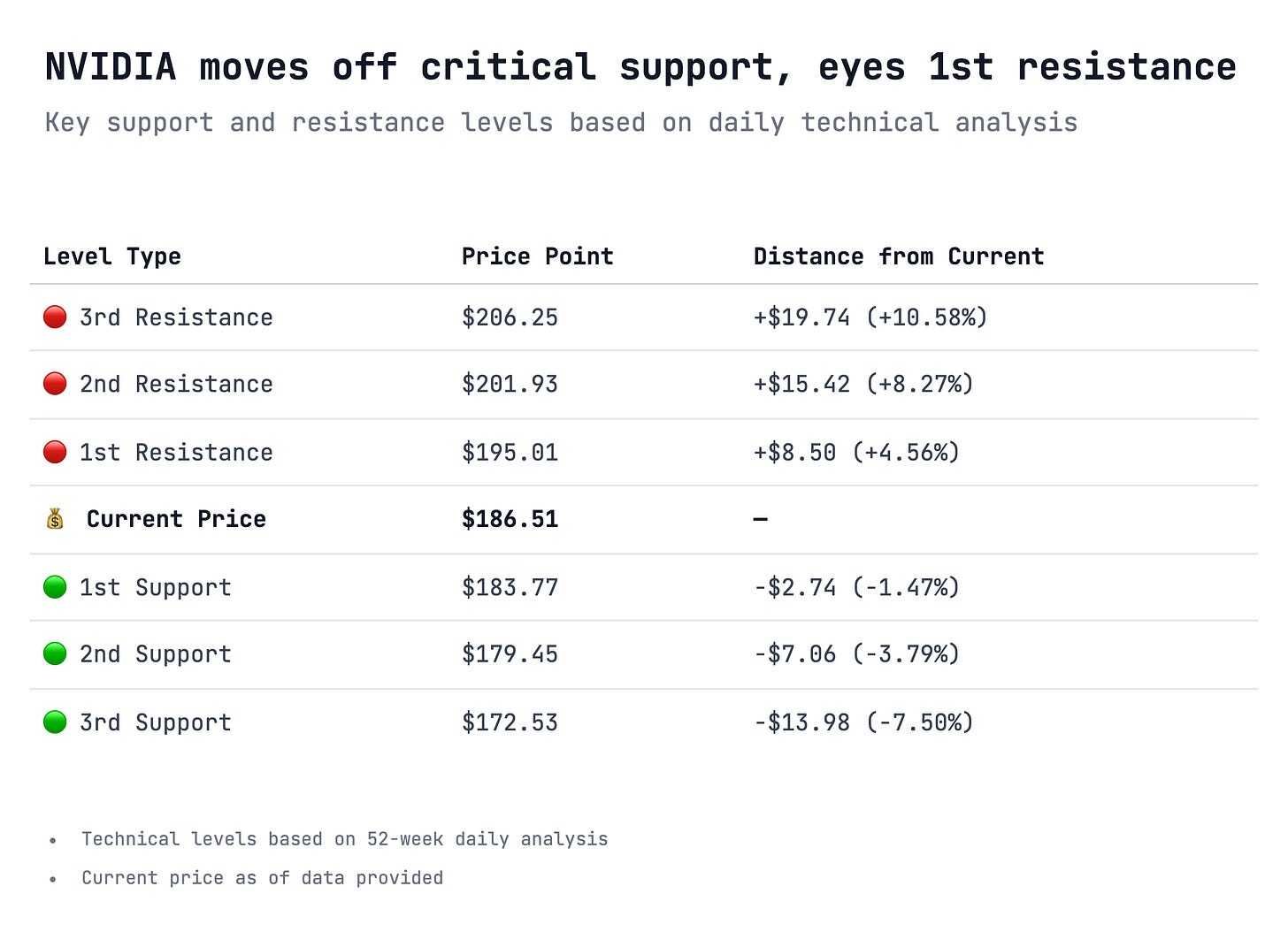

What the Chart Shows

The green circled candle shows a long lower wick, signaling buyers stepped in near the trendline — a potential short-term bounce attempt.

Lesson of the Day:

The Market Rewards Discipline, Not IQ.

“The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money.”

— Richard Dennis

Every trader knows the feeling — the chart turns red, logic says cut it, but your brain whispers “it might come back.”

That’s loss aversion — a built-in bias that makes pain feel twice as strong as gain. Hope kicks in next, the most expensive four-letter word in trading. You tell yourself you’re being patient, but really you’re outsourcing your decision to chance.

Add a little analysis paralysis, a bruised ego, and soon you’re frozen — waiting, watching, and quietly compounding the loss. The fix isn’t more indicators or data; it’s discipline. Hard stops aren’t glamorous, but they’re survival gear.

The traders who last don’t outsmart the market — they out-discipline it. Small losses are tuition; emotional control is the edge.

Cut early. Move on. Trade another day.

Key levels:

💬 Share Your Lesson:

When did a small loss turn into a big lesson for you?

Drop your story in the comments here.