Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

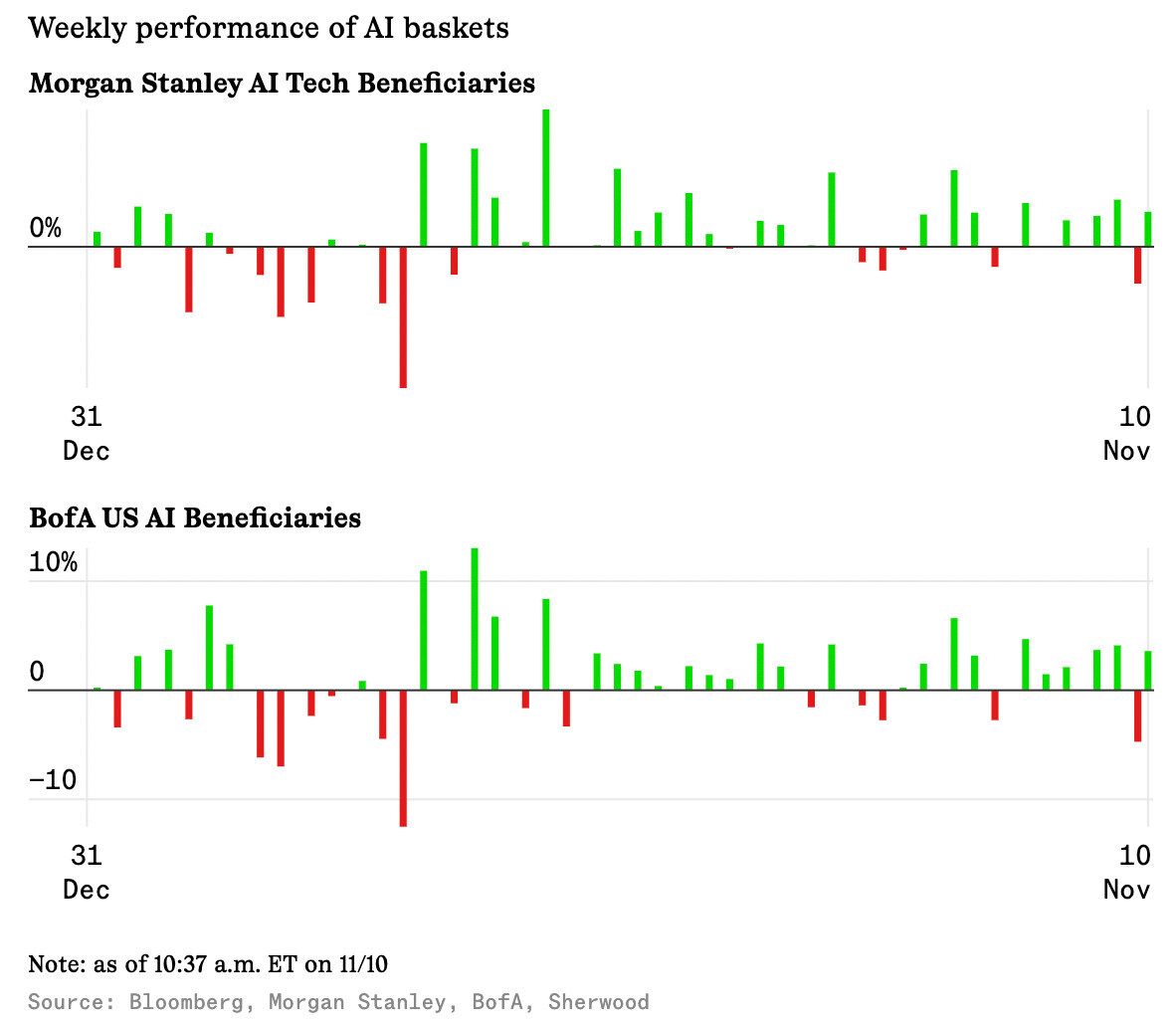

The AI trade is back online after its worst week since April’s tariff shock.

Baskets of U.S. AI stocks tracked by Morgan Stanley and Bank of America — down 7–8% last week — surged 3.5%+ Monday, leading a broad market rebound as optimism builds that the government shutdown could soon end.

📈 Leaders of the bounce:

→ Palantir (PLTR) ▲ 8.81%

→ Western Digital (WDC) ▲ 6.9%

→ Seagate (STX) ▲ 5.31%

Chipmakers also caught a bid after Nvidia’s Jensen Huang reportedly asked TSMC to ramp up output — a quiet vote of confidence in demand.

Bubble Talk (Or Not)

Some traders see last week’s drop as a crack in the AI narrative. Others see a reset.

Wedbush’s Dan Ives called it a recalibration — a natural cooldown before the next phase of trillion-dollar infrastructure spending.

Bank of America’s Vivek Arya argued the same, rejecting the “AI bubble” label tied to OpenAI’s financing issues as cherry-picked noise. Most AI spending, he noted, comes from profitable hyperscalers — Google, Amazon, Microsoft — upgrading mission-critical systems. Google’s $92 B capex protects a $200 B search business, while OpenAI and Anthropic together now serve 1.3 M+ business clients, keeping the arms race alive.

The selloff, in other words, wasn’t about AI losing steam — it was macro noise: a frozen jobs report, shutdown gridlock, and tariff tension.

And with AI earnings growing 3× faster than the rest of the S&P 500 (22V Research), the story’s still about growth, not collapse.

After declining sales, Trump's threats, and a 45% stock plunge…

Tesla just roared back to positive territory.

And mark my words, this is just the beginning.

Because once Tesla's 250x AI breakthrough goes mainstream on January 29…

We're looking at a wealth creation event 14x bigger than the ChatGPT boom.

Valuations in Context

Even with the latest pullback, the numbers don’t justify panic. The Magnificent Seven still trade at a 36% premium to the S&P 500 — pricey, but below their 10-year average of 45% and far from bubble territory.

Earnings remain the anchor: the group’s Q3 profits jumped 26.7% year over year on 17.6% higher revenue, and estimates for Q4 continue to rise. With Amazon and Alphabet posting accelerating cloud growth and Microsoft increasing capex to ease capacity constraints, investors seem comfortable paying up for visibility.

In short, the premium reflects dominance — not delirium.

The Bigger Picture

Even as the macro backdrop stays messy — consumer sentiment dropped to 50.3 (the weakest since 2022) and the jobs report remains MIA thanks to the shutdown — the market continues to lean on AI for stability.

If Nvidia’s November 19 earnings hit expectations (EPS $1.25 on $54.6 B revenue), it could reignite risk appetite across the board. But any sign of slowdown could revive the “bubble” talk fast.

Either way, the market’s message is clear: AI is still the heartbeat — everything else is just the pulse.

UBS Joins the Bulls

UBS just turned the dial even higher — predicting the S&P 500 hits 7,500 by 2026, fueled by AI-led corporate profits.

Roughly half of that expected earnings growth comes from tech, with UBS estimating AI-related capex added 0.78 percentage points to GDP growth in the first half of the year.

UBS admits the setup echoes the late-1990s tech buildout — but insists the “AI bubble” isn’t destined to burst:

“The drama of a bubble inflating and exploding isn’t inevitable… The key is monitoring how AI productivity spreads beyond tech.”

In short: profits, not hype, will decide if AI’s next leg is sustainable.

What the Chart Shows:

Lesson of the Day - Reading Fear in the Tape

Last week’s AI sell-off showed how fast sentiment can swing from euphoria to panic — and back again.

One of the simplest ways to track that mood shift? The Put-Call Ratio.

The Put-Call Ratio (PCR) measures how many put options (bets on downside) trade versus calls (bets on upside).

How to read it:

Above 1.0 → More puts than calls. Fear’s in charge.

Below 0.7 → More calls than puts. Greed’s running the show.

Around 1.0 → Traders can’t make up their minds.

Here’s the catch — the PCR works best as a contrarian signal.

When everyone’s loading up on puts, markets often find a floor. When everyone’s chasing calls, a top isn’t far away.

Why it matters now:

Just as investors dumped AI names last week and piled back in today, extremes in sentiment rarely last long.

The PCR simply quantifies what you just saw happen: fear peaks before price bottoms.

💬 Share Your Lesson:

How do you tell the difference between a real reversal and a reset?

Share your story below.

Drop your story in the comments here.