Don’t forget to cast your vote 👇

A policy rumor just lit up an entire sector.

Cannabis names ripped higher after reports that the Trump administration is preparing an executive order to reclassify marijuana, a shift that would instantly make U.S. operators more profitable by removing their two biggest structural headwinds: punitive taxation and restricted banking.

The Washington Post broke the story Thursday evening; multiple outlets confirmed. A White House official maintained that “no final decisions have been made.” Markets ignored the caveat.

Midday — 1:20pm CDT

A sector that has spent years suffocating under federal contradictions finally caught a bid big enough to matter.

But here’s the real story:

This isn’t the first time reclassification has been floated — it’s the most credible the rumor has ever been.

Let’s break down why this move happened, what the rumors actually imply, and why history says the market may be pricing hope, not certainty.

THE BREAKDOWN:

1) Reclassification = A Regulatory Earthquake

Marijuana is currently a Schedule I drug, grouped with heroin and LSD.

Moving it to Schedule III would:

→ eliminate the 280E tax burden that destroys margins

→ expand access to banking and mainstream lenders

→ enable medical research pathways

→ legitimize financial reporting and institutional ownership

Reclassification doesn’t legalize cannabis nationwide — but it pulls the industry out of regulatory purgatory.

For U.S. operators, this isn’t sentiment. It’s math.

2) Why the Market Reaction Was So Extreme

Because the cannabis sector has been absolutely crushed:

Tilray down 15% YTD

Canopy down 40% over three years

Even in Canada — legal since 2018 — Canopy has never posted a profit.

Sentiment was already priced like the industry was in terminal decline.

One regulatory headline acted like a match in a room full of dry kindling.

And that’s what traders are betting on:

the possibility of a regime change, not the guarantee.

3) Normally, “reclassification chatter” is noise.

This round is different. A consistent narrative emerged across The Washington Post, CNBC, Reuters, Barron’s, and Bloomberg:

→ Trump met with major industry executives Wednesday.

→ HHS Secretary RFK Jr. and CMS head Mehmet Oz were present.

→ The meeting reportedly included a direct call to Speaker Johnson.

→ Executives pushed; Trump appeared persuaded.

Multiple outlets confirm the same narrative: this isn’t speculation — it’s a structured internal discussion.

In this sector, expectations drive price.

A higher chance of reform = higher prices, even without confirmation.

4) What Schedule III Fixes — Immediately

For U.S. operators, two constraints define the industry’s financial ceiling:

A) 280E taxation:

Cannabis companies can’t deduct ordinary business expenses.

Margins are annihilated. Schedule III eliminates this overnight.

B) Banking access:

Limited lending, high borrowing costs, no bankruptcy protections.

Rescheduling attracts banks, lowers capital costs, and changes balance-sheet risk.

In other words:

Rescheduling is not legalization — but it’s the first time profitability becomes structurally possible.

5) We’ve Heard This Before

Trump has teased this decision multiple times and cannabis reform has repeatedly died in Congress.

August: “Decision coming in weeks.”

November: Floating the idea again.

Friday: Multiple anonymous sources say an order could come Monday.

Each time, cannabis stocks have behaved the same way:

→ Tilray +41% on Aug. 11

→ Canopy +26% on the same day

→ Similar short-lived surges… then reality reasserted itself

Why? Because reclassification still requires:

A full DOJ rulemaking

DEA review

Public comment

Months of procedural steps

Even with an executive order, nothing becomes immediate.

A White House official told Barron’s:

“No final decision has been made.”

6) Hope Is a Catalyst — Until It Isn’t

This is a classic policy-volatility repricing event:

→ The rumor surfaced with institutional credibility

→ The market had deeply discounted the probability

→ The sector is heavily short, structurally impaired, and under-owned

→ A single regulatory catalyst meaningfully changes cash flow trajectories

This creates asymmetric price action — precisely what we saw Friday.

THE TAKEAWAY:

It does fix the math

The market isn’t celebrating legalization.

It’s repricing the probability of profitability.

Reclassification won’t solve interstate commerce, won’t resolve federal–state contradictions, and won’t fix the industry’s debt load.

But it would remove the most suffocating structural barriers — and traders reacted exactly the way you’d expect when a multi-year regulatory overhang finally shows cracks.

A sector that hasn’t had a real catalyst in years just got one.

LESSON OF THE DAY:

Why Cannabis Trades on Headlines

Cannabis is a $77B market, based on 2024 estimates, that still behaves like an emerging asset class. Most of that revenue — about $64B — remains in the illegal market, meaning legal operators are fighting for share in a space that’s already mature in demand but immature in regulation.

With over 300,000 jobs tied to the sector and rapid expansion underway, the industry isn’t small. But publicly traded cannabis companies remain constrained by federal classification, taxes, and limited banking access.

That’s why headlines about rescheduling or legalization move these stocks more than earnings do. The industry’s valuation isn’t really about yesterday’s revenue — it’s about tomorrow’s rulebook.

Lesson of the Day: Buy the Rumor, Sell the Fact

News traders trade expectations, not confirmations.

Rumors move prices because markets reprice the odds instantly.

How it works:

→ Rumor = positioning

→ News = profit-taking

→ Edge = short-lived

They trade the volatility around big events and react fast to surprises.

Bottom line: Markets move when probabilities shift — which is why a cannabis rescheduling rumor moved the sector before policy did.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Enjoying this post?

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

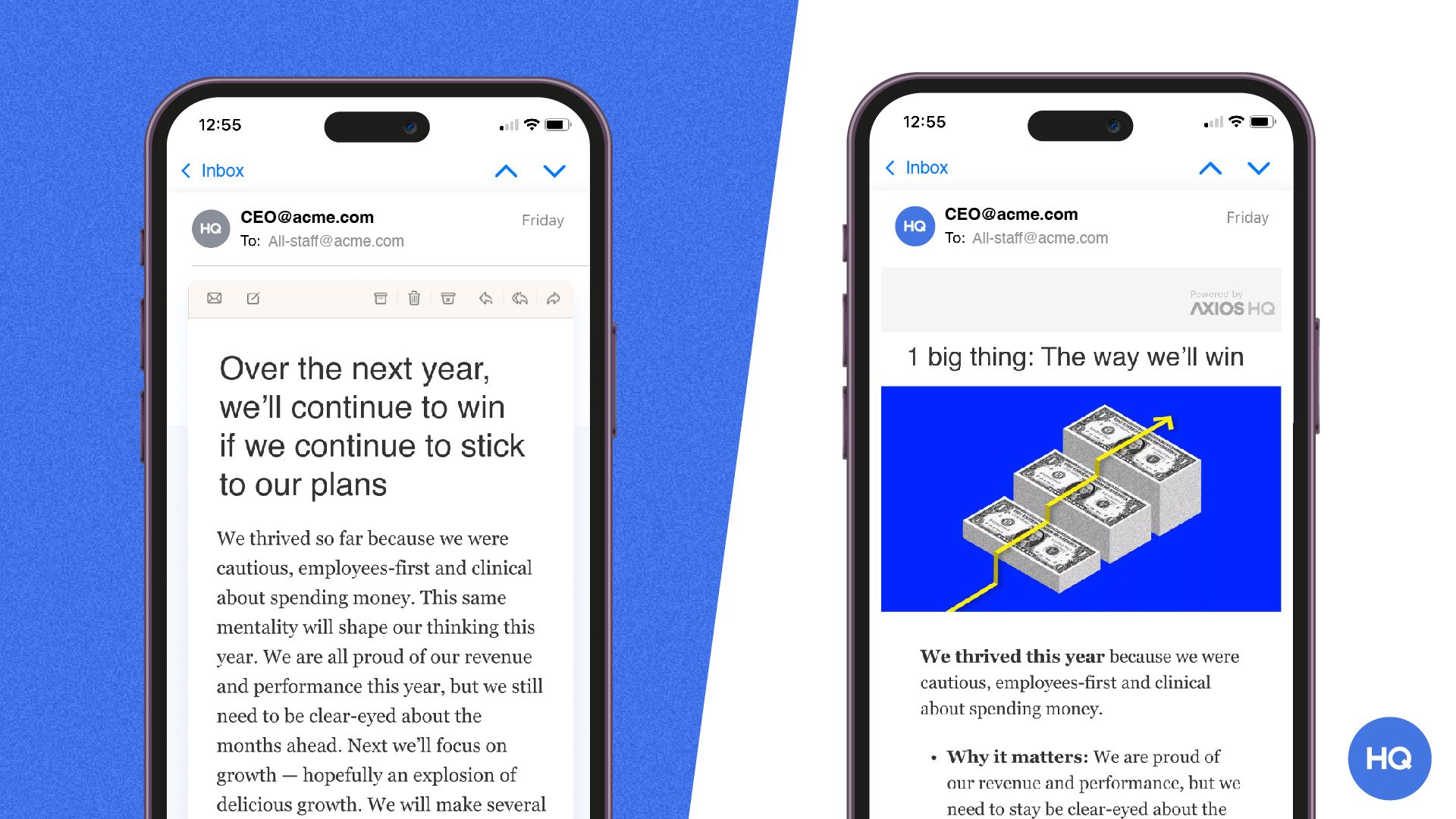

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

❗ P.S. - If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇