Don’t forget to cast your vote 👇

Netflix’s $82.7B deal for Warner Bros. Discovery was supposed to be the end of the story.

Instead, it was the start of a fight.

This morning, Paramount Skydance launched a hostile takeover bid for all of Warner Bros. Discovery — a $108.4 billion all-cash offer at $30 per share, designed to blow up Netflix’s agreement and seize the studio outright.

It’s rare to see a full-scale bidding war in modern media.

Hostile bids at this scale are nearly extinct — financing is expensive, antitrust risk is high, and boards usually shut down rival offers before they ever reach shareholders.

It’s even rarer when:

the White House is already signaling antitrust concerns,

regulators are circling,

and the target company hasn’t endorsed any bidder.

Yet here we are. The streaming war just went from consolidation… to combat.

Let’s break down what Paramount’s offer does to Netflix, Warner Bros., and the entire probability tree.

THE BREAKDOWN:

1) Paramount Escalates — With an All-Cash Hostile Bid

Paramount isn’t countering Netflix’s structure. They’re rejecting it entirely.

Their offer is:

→ $30 per share, all cash

→ $108.4B enterprise value

→ a bid for the entire company, not just studios + streaming

→ directly to shareholders — bypassing WBD’s board

For context:

Netflix’s deal was $27.75 per share, partly stock

$WBD values Netflix’s offer closer to $31–32 with the spinoff included

Paramount’s previous offers topped out at $58B

This new offer nearly doubles Paramount’s last attempt.

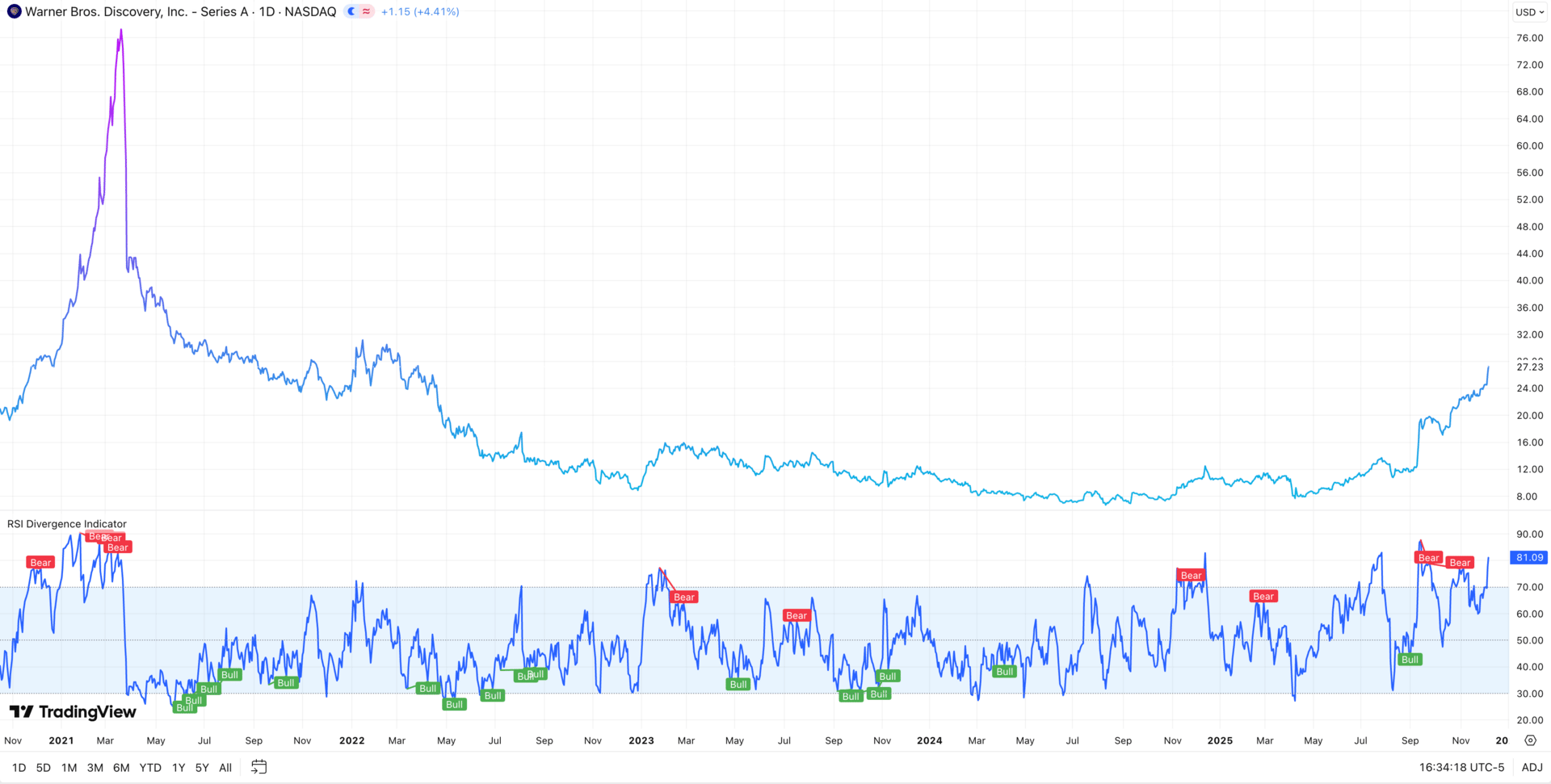

Investors immediately reacted:

$WBD ↑ ~7%

$PSKY ↑ ~7%

$NFLX ↓ ~4%

Hostile bids aren’t cheap.

This is an attempt to rewrite the entire deal landscape overnight.

2) Why This Is Suddenly Possible: Financing Became “Clean”

Warner had dismissed Paramount’s earlier proposals as:

underfunded

overly complex

reliant on outside capital with governance strings attached

So Paramount returned with something regulators and shareholders can’t ignore:

→ Ellison family + RedBird Capital are backstopping 100% of the $40.7B equity

→ Middle Eastern sovereign wealth funds (Saudi, Abu Dhabi, Qatar) agreed to forgo governance rights

→ Kushner’s Affinity Partners also accepts non-voting equity

In deal speak: No control rights, no board seats, no political entanglements.

This dramatically lowers the “foreign governance” objection — and makes Paramount look more organized than in prior attempts.

3) Netflix’s Deal Now Faces a New Threat: Timing Risk

Netflix was already staring down:

bipartisan antitrust fire

an election year

EU scrutiny

a massive regulatory review timeline

Now add:

→ a competing bidder with a higher cash offer

→ shareholders incentivized to wait

→ a target company encouraged to stall the process

→ a DOJ that may prefer a smaller buyer

Every day this deal remains unapproved, Netflix’s risk increases.

The market understands that.

Hence $NFLX ▼ again today.

Before today, WBD shareholders had one path:

Accept the Netflix deal at ~$23.35 cash + $4.50 NFLX stock

Receive the Discovery Global spinoff shares

Now they have three:

Path A: Take Paramount’s $30/share all-cash

Path B: Hope Netflix raises its offer

Path C: Wait for regulatory pressure to force divestitures that increase bargaining power

Shareholders love optionality.

Boards hate hostile bids.

Markets price both.

$WBD jumped, but not to $30 — meaning investors expect:

→ negotiation

→ delays

→ deal spread volatility

→ regulatory conditioning

This is now true merger arbitrage.

5) Why This Could Get Worse for Netflix Before It Gets Better

Netflix now faces the specific risk that traders call:

“Two-Front Deal Pressure.”

The risks expand, not linearly, but exponentially:

→ Front 1: Regulatory friction

The DOJ already questioned market concentration; now it must evaluate two very different market structures.

→ Front 2: Shareholder preference friction

If enough WBD shareholders prefer $30 cash, Netflix’s deal may be structurally disadvantaged.

→ Front 3: Bid escalation risk

If Netflix raises its offer, leverage rises — again.

→ Front 4: Time decay

The longer this takes, the more the antitrust narrative heats up.

Netflix tried to buy certainty. Instead, it bought a timeline that no longer belongs to Netflix.

THE TAKEAWAY:

The Math Changed…

Friday’s selloff made sense.

Today’s makes even more sense.

Paramount didn’t just offer more money.

It expanded the risk surface around Netflix’s deal and forced the market to reassess:

The likelihood Netflix completes the acquisition

The likelihood Netflix must raise its bid

The regulatory pathway’s complexity

The expected time to resolution

The dilution and debt implications for Netflix shareholders

Deals aren’t about who pays the most. They’re about who can close.

And today, the market priced in a new reality:

Netflix no longer holds control of the timeline — or the narrative.

Why This Hostile Bid Is So Unusual

Hostile takeovers on this scale are almost extinct in modern corporate strategy.

Boards structure defenses, regulators tighten controls, and financing complexity usually kills aggressive bids before they launch.

For a move this hostile and this large to happen, several rare conditions had to line up:

1) A once-in-a-generation asset came into play.

A century of Warner Bros. IP + HBO’s prestige catalog doesn’t hit the market twice.

Paramount knows this is the last “crown jewel” left in streaming.

2) The industry is under structural pressure.

Streaming economics are breaking: slower growth, higher costs, tougher competition.

When survival is at stake, companies take risks they normally wouldn’t.

3) Netflix’s negotiated deal was politically exposed.

The backlash from both parties created a window — one that hostile bidders almost never get.

4) Paramount solved the financing problem.

Hostile bids fail because money gets messy.

This time, Paramount came back with clean capital, no governance strings, and full equity support.

5) The first bidder (Netflix) gave shareholders a reference price.

Once a price exists, a hostile bid only needs to beat it — and add certainty.

Paramount did both.

Why it matters:

This bidding war is a challenge to the entire structure of how media consolidation works.

LESSON OF THE DAY:

Hostile takeovers create a unique price dynamic traders should understand:

1) Control shifts from boardrooms to markets.

Shareholders — not executives — decide whether a higher offer is “superior.”

A $30 bid doesn’t cap valuation.

It anchors negotiations upward.

3) Competing bids widen the deal spread.

More bidders = more uncertainty = more volatility.

4) Regulators gain leverage.

Multiple structures give DOJ the ability to play bidders against each other.

5) Stocks react to probability, not proposals.

The hostile bid premium reflects uncertainty — not enthusiasm.

Critical takeaway:

Hostile bids don’t guarantee new winners.

They guarantee new risk curves.

Traders make money by understanding which curves just got steeper.

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Enjoying this post?

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you've worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don't. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

❗ P.S. - If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇