Dollar bears are feeling it. After months of betting on a weaker greenback, the “short-dollar” crowd is getting squeezed as the U.S. currency quietly climbs back toward two-month highs.

The move has caught traders off guard. Even with Washington stuck in a shutdown and investors still pricing in rate cuts, the dollar isn’t fading — it’s firming. Hedge funds that had leaned into the anti-dollar trade are now scrambling to unwind, and even Wall Street’s biggest names — Goldman, JPMorgan, Morgan Stanley — are backing away from their bearish calls.

What Happened:

Several global currents are converging.

Fed Tone Shift: Policymakers have been more cautious about cutting too aggressively. The market priced in a full cycle of cuts; now reality looks less generous.

Relative Weakness Abroad: The euro and yen have been sliding on political and fiscal worries — from leadership changes in Japan to continued strain in France. That makes the dollar look, as traders say, “the least dirty shirt in the pile.”

Positioning Risk: Speculators are still net short the dollar, though less than earlier this year. That leaves room for a classic short squeeze — forced buying that drives prices even higher.

The Bloomberg Dollar Spot Index has already clawed back about 2% since mid-year, reversing part of its sharp first-half decline. What began as a one-way bet on Fed easing has turned into a test of conviction.

What the Chart’s Saying:

1\ Street Still Leaning Against the Buck

What it shows: Consensus still expects the euro, yen, and pound to gain into year-end — a setup that keeps the dollar trade crowded on one side.

What it means: If the dollar keeps rising, short-sellers may rush to cover, pushing it even higher. That could make global borrowing more expensive and weigh on other currencies.

2\ Slide Loses Momentum

What it shows: After months of weakness, the Dollar Spot Index has rebounded ~2% since July — signaling the short trade’s losing steam.

What it means: The comeback suggests investors may have gone too far betting on rate cuts. A stronger dollar can pressure commodities and emerging-market stocks but helps lower inflation abroad.

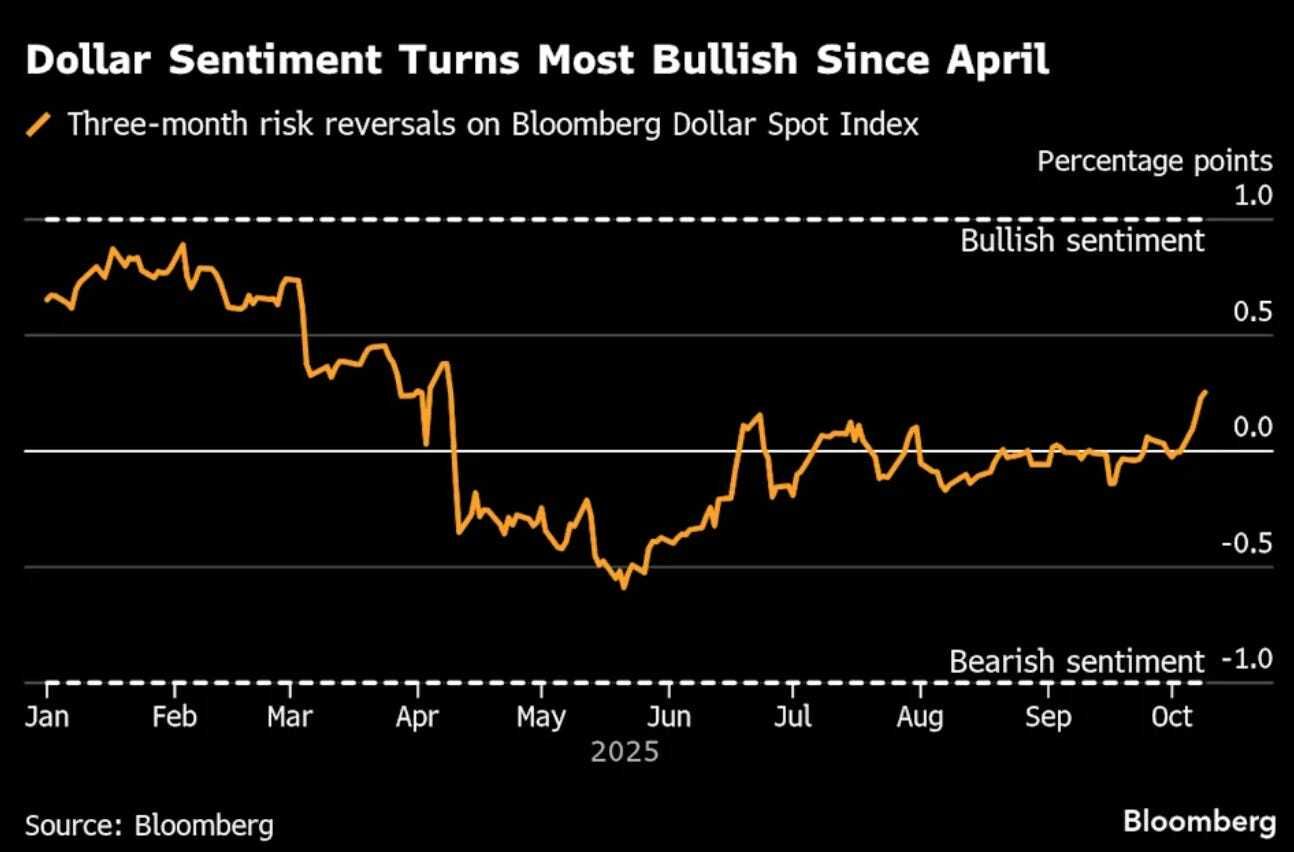

3\ Sentiment Flips

What it shows: Options skew has turned positive for the first time since spring, showing traders are finally paying up for dollar upside.

What it means: Traders are hedging for more dollar strength, showing a clear shift in confidence. That can lead to more volatility as old bets unwind.

When Crowds Get Comfortable:

Every market cycle has a darling trade — the “can’t-miss” setup that becomes everyone’s favorite idea. This year, it was shorting the dollar.

But consensus trades carry hidden risk. The more crowded they get, the smaller the margin for error. A hint of data divergence, a shift in policy tone, or even positioning fatigue can flip sentiment fast.

In FX, that flip can be brutal — especially when the trade depends on relative weakness elsewhere. If Europe and Japan stay unstable, the U.S. looks strong by default. And that’s all it takes for the pain to compound.

The Lesson:

When too many traders lean in the same direction, markets find balance the hard way.

The dollar rally isn’t about sudden U.S. strength — it’s about everyone being wrong at once. It’s a reminder that in macro trading, conviction needs flexibility. Short squeezes don’t care how good your thesis sounded on paper.

Stay nimble, watch your exposure, and remember: the easiest trade usually ends the hardest.