Before you scroll down, cast your vote 👇

Poll of the Day:

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

This week delivered three very different stories under the same market roof.

Alphabet climbed to new highs and looked completely unfazed by the AI volatility.

Nvidia showed, again, that real demand doesn’t care about mood swings.

And Bitcoin triggered one of its rarest long-term sell signals — the kind that makes even seasoned traders pause.

Three different signals.

One uneasy market.

Let’s get into what’s actually happening beneath the surface.

Alphabet Comfortably Survives AI Panic…

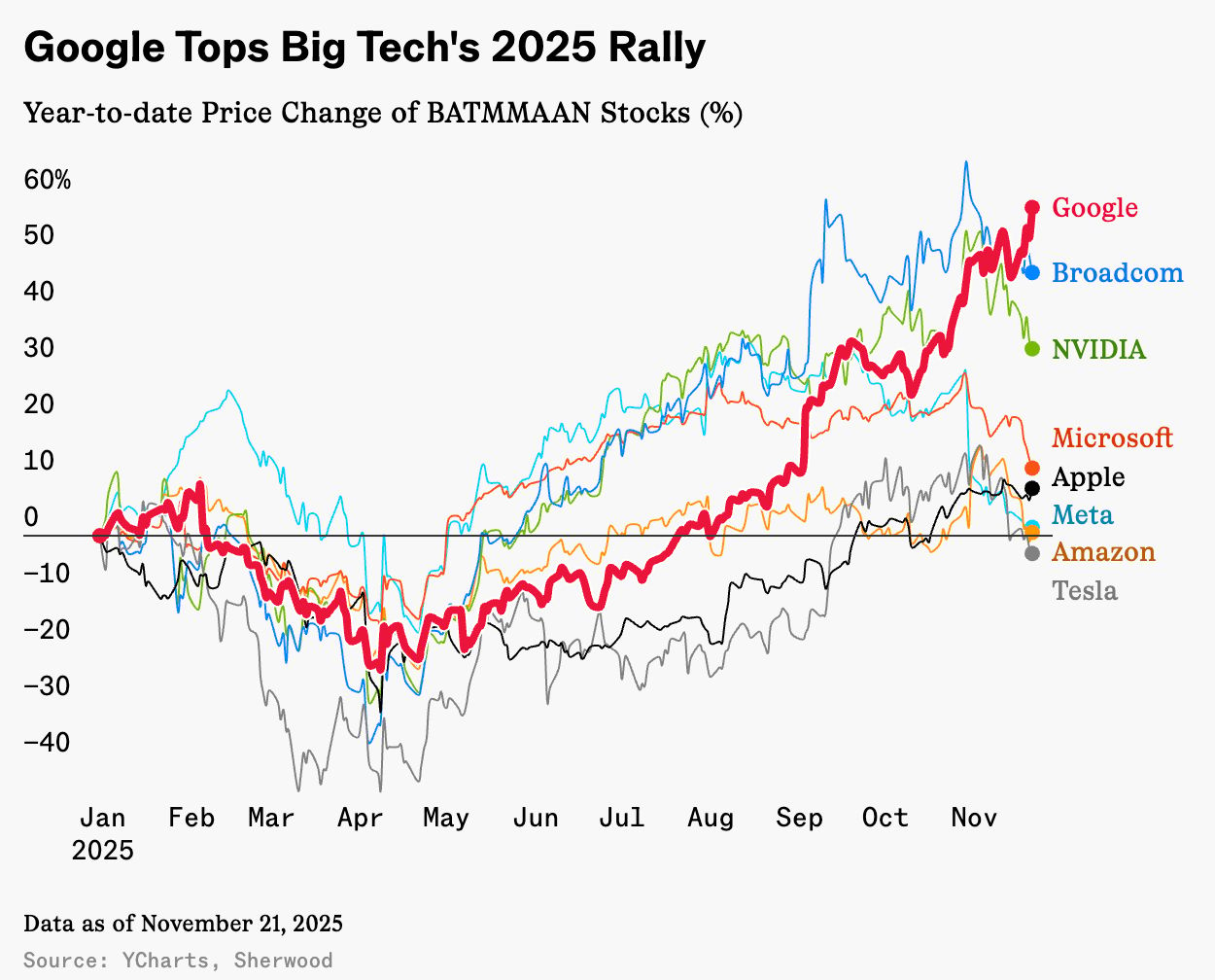

While the AI trade spent the week wobbling, Alphabet (GOOGL) quietly did the opposite — it hit a fresh all-time high at $318.57, topping every Magnificent Seven name in 2025.

Google is now +58% YTD, leading the group with widening separation.

Not because of hype — because of execution.

What’s working:

1\ AI credibility is rising, not falling

Gemini 3 topped benchmark scores and showed major jumps in coding + reasoning — a direct answer to OpenAI and Anthropic.

2\ TPUs are the quiet trump card

Google trained Gemini 3 entirely on its own chips. That means less dependence on Nvidia, more control of the full AI stack.

3\ Cloud is accelerating

Revenue +33.5% YoY

Backlog: $155 billion (+82% YoY)

And Berkshire Hathaway quietly started a $4.3B position.

4\ Waymo has real traction

1.02M paid rides in CA in September

Expanding to highways, airports, and seven new cities in 2026.

5\ Search is evolving — not eroding

AI Overviews → 1.5B monthly actives

ChatGPT pressure is real, but Google is adapting faster than skeptics expected.

The takeaway:

Google isn’t trading like an AI story. It’s trading like an AI infrastructure + cloud + consumer-scale platform — one that the market underestimated.

Alphabet’s strength stands out because almost everything else is wobbling.

Message from a sponsor:

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

The Bull that Market Still Undervalues:

Another day in AI land, another dose of volatility. And right in the center of the storm sits Nvidia — the only company where demand is still running hotter than the market’s nerves.

While traders obsess over crypto meltdowns and rate-cut whispers, Nvidia’s story is moving in one direction: up.

Not hype — scale.

Here’s the reality behind the noise:

1\ AI compute demand hasn’t cooled for even a second.

Every hyperscaler, every sovereign AI project, every enterprise model — all of them still need Nvidia’s stack. The “slowdown” narrative isn’t in the numbers. Not even close.

2\ Analysts walked into Q3 with weak estimates — and had to scramble.

FY revenue forecasts went from $275B → $293B, with the high-end now hitting $327B.

That shift didn’t happen because the market felt generous.

It happened because Nvidia forced the math.

3\ Jensen Huang is basically doing global industrial policy at this point.

Beijing → Seoul → Taipei → Riyadh → London → D.C.

He’s not pitching GPUs — he’s explaining a full rewiring of global productivity.

And world leaders are listening.

4\ Colette Kress doubled down on the $500B Blackwell + Rubin roadmap.

Then added more:

Saudi demand for another 400k–600k GPUs.

New orders from Anthropic.

Upside still on the table.

5\ This isn’t “the next iPhone cycle.” It’s a datacenter rebuild from scratch.

Sovereign AI, Agentic AI, Physical AI — every frontier requires entirely new compute infrastructure. Traditional models can’t capture the scale.

6\ And the developer moat? Still bulletproof.

CUDA isn’t a product — it’s a lock-in ecosystem.

Once you build on it, you don’t leave.

So while the broader AI trade wobbles…

Nvidia’s fundamentals aren’t wobbling at all.

If anything, the market is the one flinching — not the company.

The takeaway:

Nvidia is still the bull of the day — the one part of the AI stack where demand hasn’t cracked, forecasts keep rising, and the leadership team keeps telegraphing a multi-trillion-dollar runway.

The volatility around it?

That’s the market trying to catch its breath.

How High-Net-Worth Families Invest Beyond the Balance Sheet

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how you compare to your peers.

Message from a sponsor:

Lesson of the Day: Bitcoin’s MACD Warning

Bitcoin just triggered one of its rarest technical alarms.

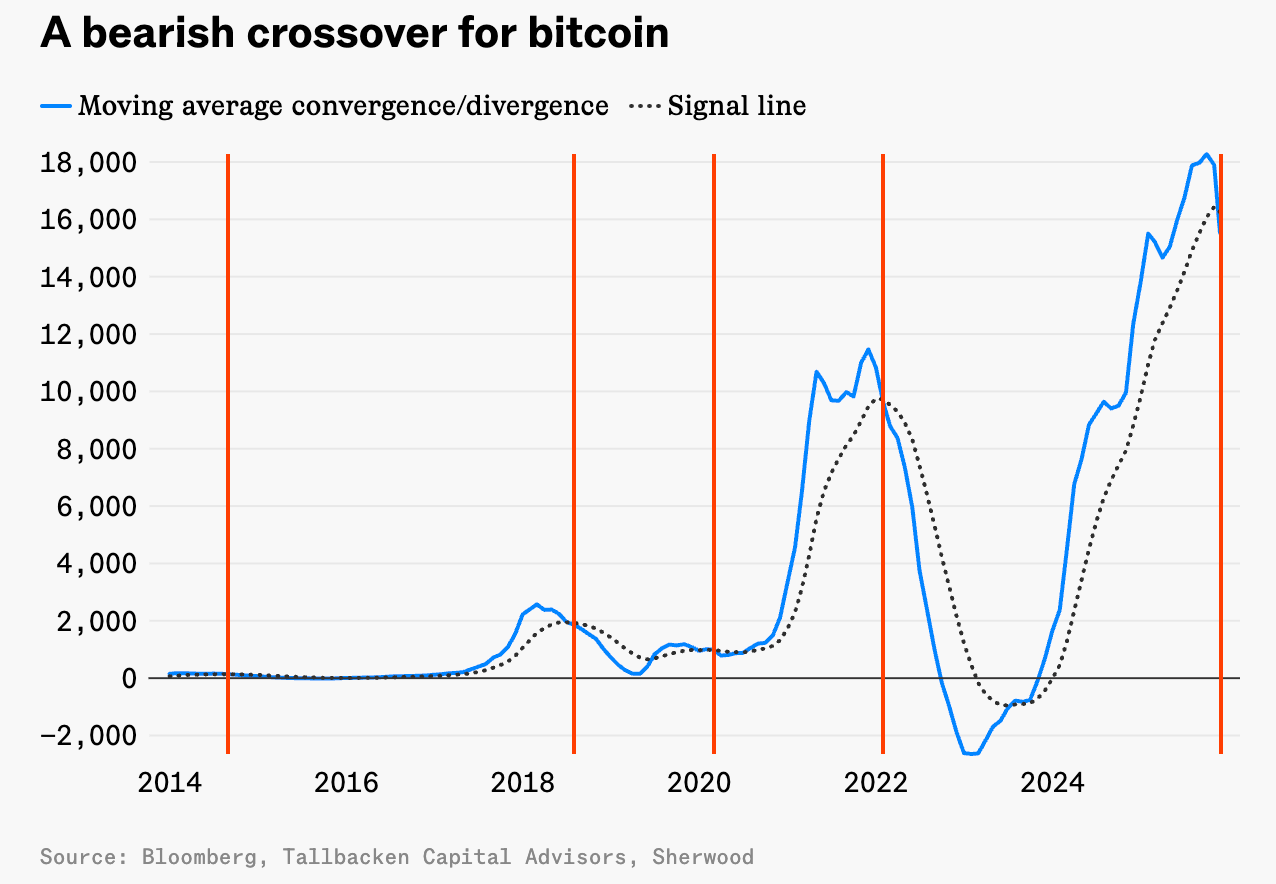

The monthly MACD (Moving Average Convergence Divergence) sell signal, which has appeared only six times in BTC’s history, just fired again.

Historically:

• 80% of past signals led to deeper drawdowns

• Average decline after the signal: –60%

• Sellers accelerate, dip-buyers disappear, momentum turns fully bearish

Why it matters:

This is a long-term, slow-moving indicator.

When it flips, it signals a structural shift — not noise.

But here’s the nuance traders need:

Bitcoin is also very oversold (daily RSI ~22) and bouncing repeatedly near the $80K support, the same level as the Liberation Day lows.

That means:

→ Short-term: consolidation or a reflex bounce is likely

→ Long-term: the MACD is warning that the broader cycle may not be done unwinding

For now, $75K–78K remains the key zone.

Break it — and the MACD history becomes hard to ignore.

What the Chart Shows

These charts highlight one of Bitcoin’s rarest long-term bearish signals: a monthly MACD crossover, marked by the red vertical lines.

Historically, this signal only shows up at major momentum shifts — moments when bullish cycles fade and deeper corrections begin. Out of the past six occurrences, most preceded multi-month drawdowns, liquidity squeezes, or full-cycle resets.

Let’s zoom in on the MACD itself, where the blue line has now crossed below the signal line — confirming that long-term momentum has flipped from expansion to contraction and that momentum has decisively turned bearish.

💬 We Want To Hear Your Story:

We want to hear about your wins, your losses, and everything in between.

Drop it in the comments here.