Don’t forget to cast your vote 👇

Poll of the day:

Okay — quick thought experiment.

It’s 8:17 p.m.

You open your phone.

You ask ChatGPT something dumb.

You get an answer in seconds.

Feels instant and frictionless.

What you don’t see is the army of servers, power plants, cooling systems, and transmission lines working overtime to make that answer appear.

Somewhere, a transformer is sweating.

Somewhere, a data center is drawing enough power to run a small city.

Somewhere, a local grid operator is praying nothing trips.

There’s actually a technical reason for this — and it has nothing to do with “AI being smart.”

It’s called compute demand.

And right now, it’s growing faster than our power grids.

The Setup

AI is starting to follow a predictable path.

Phase 1: Build giant campuses where land is cheap.

Phase 2: Move compute closer to people, because latency is a product feature.

That’s why the story is shifting.

This is no longer a story about chips or chatbots.

It’s a story about the grid, water, tax deals, and communities asking the obvious question:

Who’s paying for this?

This week gave us the cleanest snapshot yet:

Rural Louisiana. Downtown Chicago. Suburban Indiana.

SPONSOR BREAK presented by TheOxfordClub*

A tiny government task force working out of a strip mall just finished a 20-year mission.

And with almost no media coverage, they confirmed one of the largest U.S. territorial expansions in modern history...

A resource claim worth an estimated $500 trillion.

Thanks to sovereign U.S. law, this isn't just a national asset.

It's an American birthright.

But very few even know the opportunity exists.

If you want to see how you can get in line for your portion of this record-breaking windfall...

I've assembled everything you need to see inside a new, time-sensitive briefing:

The Maps

Rural: The Titan Clusters

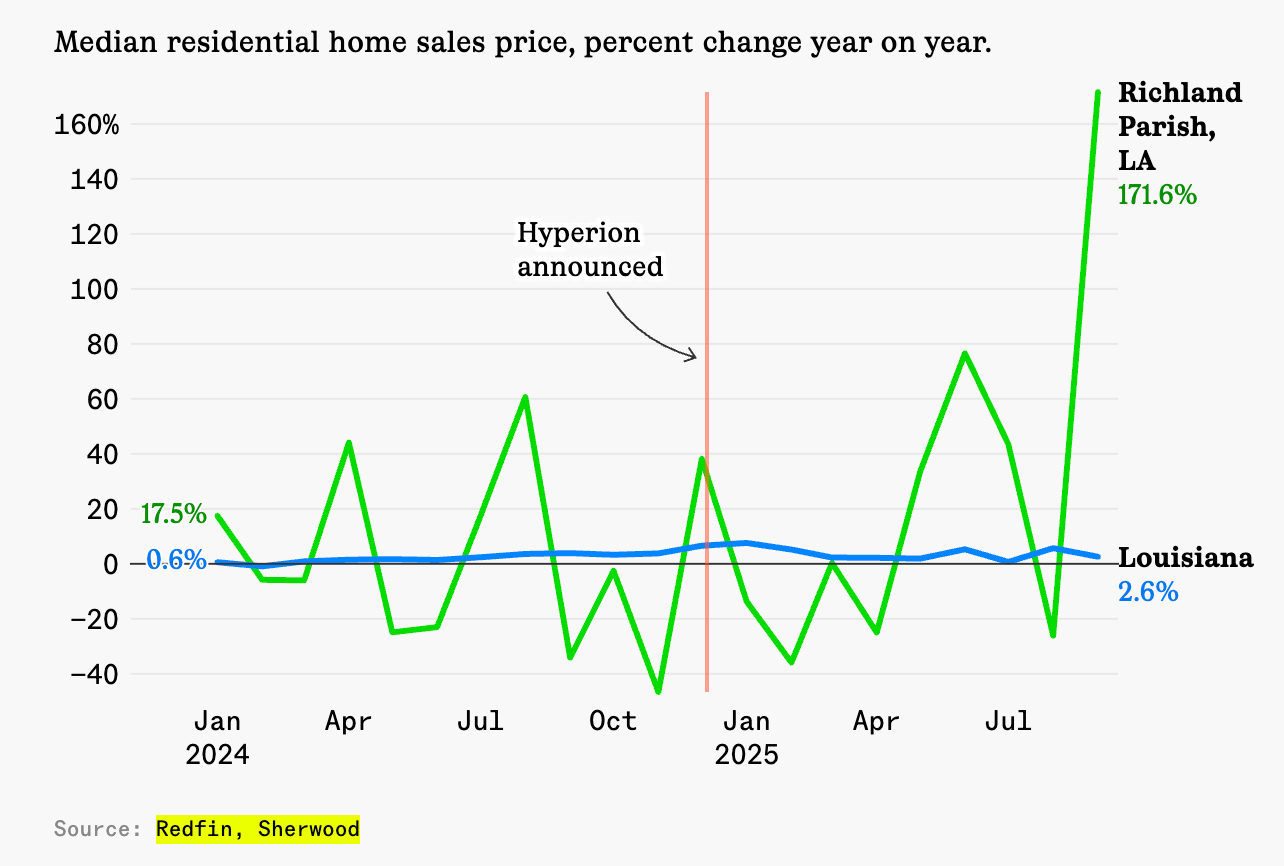

Meta’s Hyperion project in Richland Parish, Louisiana is the cleanest example of how this game gets played.

A small parish (~20k people) approves financing terms quietly.

The developer is a shell entity (Laidley LLC).

The project has a code name (“Project Sucre”).

A few months later, it’s revealed: this is Meta.

Meta says Hyperion’s first phase opens in 2028, with $10B+ of investment. Zuckerberg has described it as 2GW+ and “large enough to cover a significant part of Manhattan,” with a long-term path to 5GW.

The key detail isn’t the size. It’s leverage.

Louisiana’s incentive package is designed to remove friction:

→ Sales tax exemptions on data center equipment (GPUs, networking, cooling)

→ Public support for power infrastructure expansion.

→ Long-dated power commitments.

Sherwood estimated the GPU sales tax break alone could be $3.3B — big enough to fund years of state-level budgets.

And the jobs math is the part everyone learns too late:

peak construction: 5,000+ skilled trade roles

operations after completion: around 500 full-time jobs

The result on the ground looks like an economic boom … but also:

→ Farmland prices jumping from roughly $6,500/acre to $30,000+, with listings cited as high as $73,000/acre

→ Home prices in the parish up sharply year-over-year.

… rising questions about who really benefits.

This is the “AI factory” pitch: big spend, big excitement, then a smaller steady-state footprint than the headlines implied.

Urban: Inference Comes Downtown

Today’s Chicago story is the pivot.

A former Chicago Board Options Exchange trading floor is being converted into a 33-megawatt data center, set to open later this year.

Pause there — because this is not what people picture when they think “AI data centers.”

This is not a rural, miles-wide “titan cluster.” It’s the opposite.

This is edge compute. This is inference. This is the layer that sits close to users.

Here’s the clean way to understand the difference:

Training = building the brain.

It can happen far away, on massive campuses, where land is cheap and power is abundant.Inference = using the brain.

That has to happen near people, because speed matters.

Why? Because with AI, latency is the product.

If your AI takes 15 seconds to respond, you’ll use it less.

If it responds instantly, you’ll use it all day.

So the industry is calling 2026 the “inversion year” — the moment when more compute is spent on inference than on training.

❗If that shift is real, the real estate map changes.

Suddenly, Downtown real estate got a new use case.

✓ Vacant offices?

✓ Old industrial sites?

✓ Half-empty “powered shells”?

They’re no longer leftovers.

They’re prime inventory for AI.

SPONSOR BREAK presented by TheOxfordClub*

It wasn't stocks. It wasn't real estate. It was a little-known investment vehicle that turned Mitt Romney's $450,000 into as much as $100 million and Peter Thiel used to turn $2,000 into $5 billion within two decades. Now, thanks to a new executive order, regular Americans can access the same type of investment.

Get more details here >>

Meta’s Indiana announcement is basically the community-relations version of Louisiana.

Lebanon, Indiana is getting a 1-gigawatt data center — a $10B+ project that slots into Meta’s plan to spend up to $135B on AI in 2026 (after ~$72B in 2025).

But the real story is the terms.

This time, Meta showed up with a checkbook, not just a slide deck:

→ It says it will pay the full cost of the energy it uses.

→ $1M per year for 20 years to a community fund for energy bills.

→ A closed-loop water system that supposedly uses “no water most of the year.”

→ $120M+ for local water infrastructure.

→ Upgrades to roads, transmission lines, and local utilities.

Plain English: Meta isn’t just building a data center — it’s pre-paying the backlash.

That’s the new playbook.

source: NPR

Companies are now underwriting the “social cost” up front because otherwise projects get delayed, downsized, or canceled.

And cancellations are no longer theoretical — developers have already started walking away from projects when resistance and regulatory friction stack up.

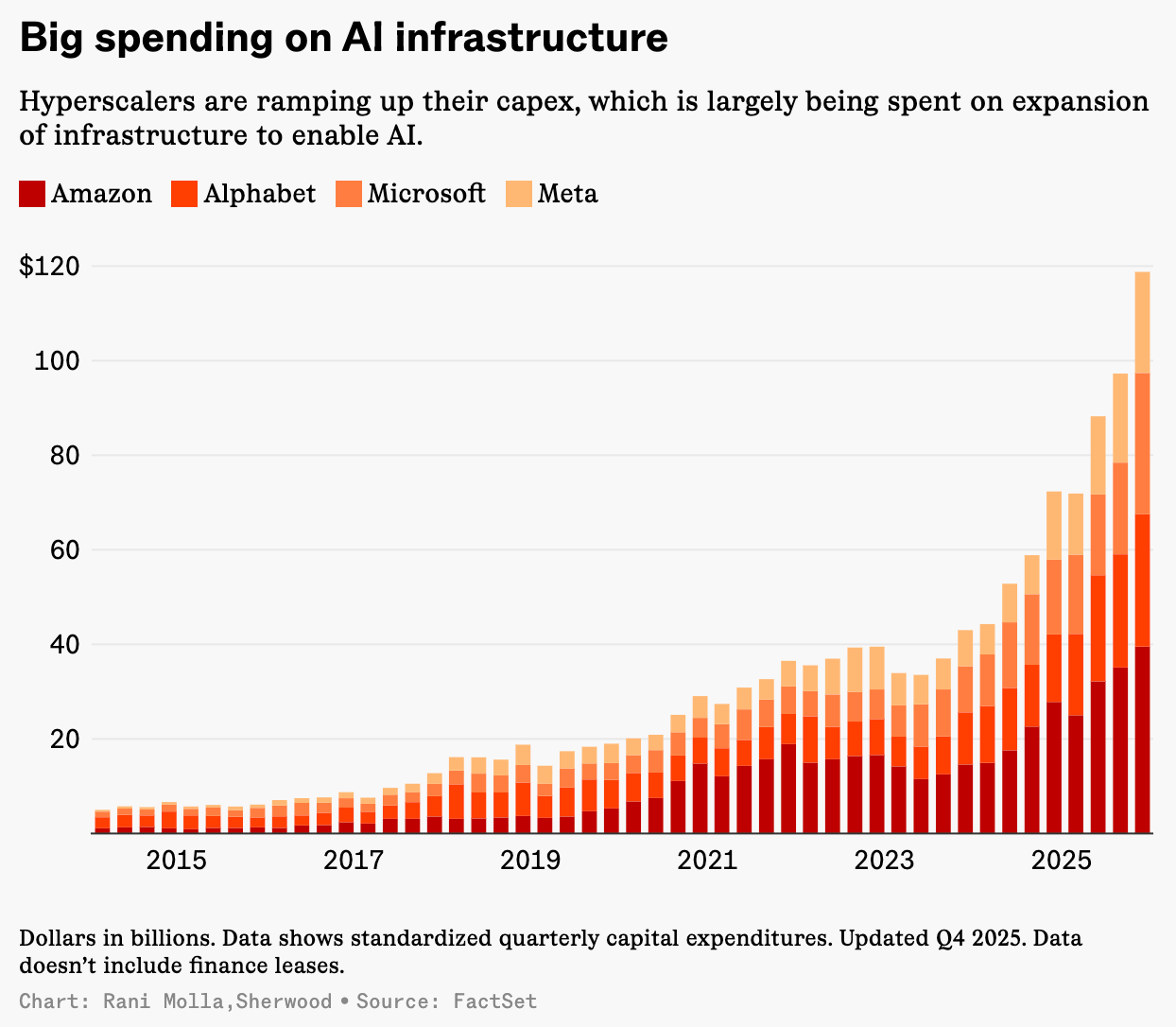

The Market Angle

All of this — Hyperion in Louisiana, edge sites in Chicago, and Meta’s concessions in Indiana — points to the same reality:

AI is becoming an infrastructure story.

And infrastructure stories are capex stories.

That’s why markets are suddenly less interested in what AI can do in theory, and much more focused on what it costs.

Which brings us to Microsoft.

Microsoft…

Why did Microsoft ( ▼ 2.2% ) sell off after what looked like “good” earnings?

The simplest answer: capex became the product.

Microsoft beat on the numbers that usually matter — revenue and EPS.

But then it disclosed $37.5B in quarterly capex, largely tied to AI infrastructure.

The market’s reaction was: “The payoff is probably real… but the timeline isn’t clear — and the spending is very front-loaded.”

That’s a different kind of risk.

So the selloff read more like a repricing of certainty.

From a trading lens, that matters:

The stock snapped back from oversold levels — classic mean reversion after a violent move.

But it’s still below its 200-day moving average, with no clean base yet.

In trader terms: mean reversion is not trend reversal.

The bigger takeaway is this:

Microsoft isn’t being punished for betting on AI.

It’s being stress-tested for how fast and how much it has to spend to win.

SPONSOR BREAK presented by BanyanHill*

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on February 17 if you want to profit.

Go here for details now — while you still have time to position yourself.

NVIDIA: The Bar Is Set High

Zoom out.

Microsoft is being re-rated because AI capex is front-loaded.

Nvidia’s ( ▲ 0.8% ) upside now depends on that capex actually getting built.

Which is why the battles over data centers in Louisiana, Chicago, and Indiana are the bottleneck in Nvidia’s bull case.

Goldman’s message on Nvidia is simple: Yes, they expect a beat.

They’re modeling roughly $2B of upside to consensus in the current quarter.

But that’s not what will move the stock.

What matters isn’t what Nvidia already earned — it’s how confident investors feel about demand lasting beyond this year.

The debate narrowed to:

→ How durable is that demand?

→ How much share leaks to ASICs or AMD?

→ How smoothly does the Rubin ramp go?

→ And what happens with China?

The question is:

How much of that future is already in the price — and how much is still optionality?

That’s why the bar feels high.

If Nvidia simply meets expectations, the market shrugs.

If it gives clearer visibility into 2027, the stock has fuel.

If anything looks shaky, investors will punish it fast.

So…

AI used to be a story about brains and chips.

Now it’s a story about concrete, power lines, and permits.

That’s why Microsoft got hit on “good” earnings — the bill arrived before the payoff.

And it’s why Nvidia’s bar is so high — its upside depends on all this infrastructure actually getting built.

In other words:

the AI boom is on a construction schedule.

Lesson of the Day

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Enjoying this post?

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. - If you no longer want to receive occasional emails from us and you want to unsubscribe, click here 👉 “Unsubscribe” . Thank you!