Don’t forget to cast your vote 👇

Poll of the Day:

Money has a personality. It depends on who’s holding it.

Some dollars like to sit still in one account.

Some dollars like to wander between apps.

Some dollars get bored easily and start hunting for a better couch to nap on.

If you’ve ever moved $200 from one account to another just because the interest rate looked slightly prettier… congratulations. You’ve participated in modern finance’s favorite sport:

Deposit hopping.

Banks used to rely on one simple truth:

Money is lazy.

Once your paycheck landed in a checking account, it basically stayed there forever. Maybe it wandered into savings once in a while. But it always came home.

That assumption is quietly breaking.

THE BRIDGE (WHAT CHANGED):

Digital dollars are getting competitive.

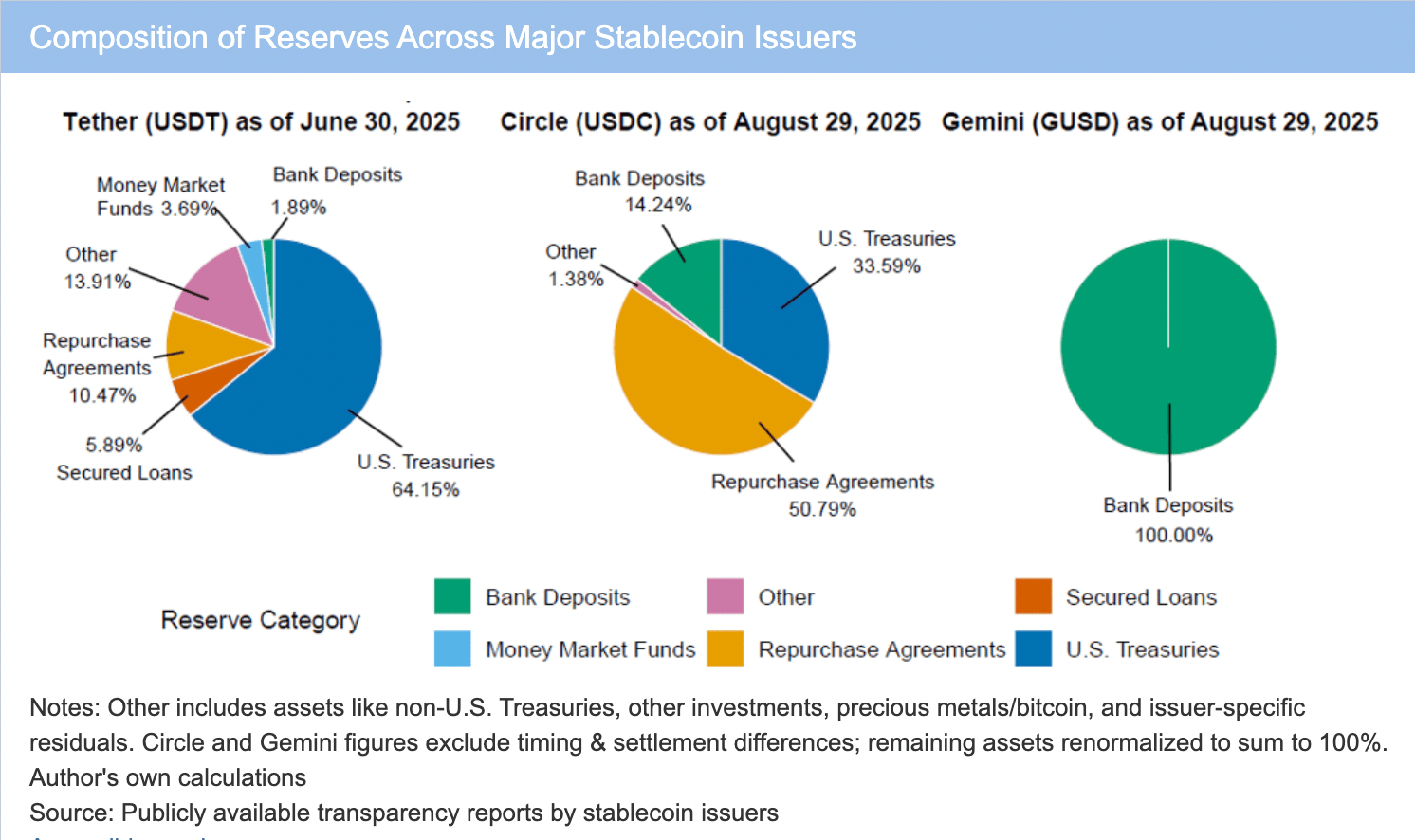

Stablecoins now represent more than $316 billion in circulating supply. People use them for payments, savings, transfers, and increasingly… yield.

Even though the GENIUS Act already bans stablecoin issuers from paying direct interest, crypto platforms found creative ways to still offer rewards through trading activity and lending mechanics.

And guess what?

Those rewards often beat traditional savings accounts that quietly pay something close to “thanks for nothing.”

Banks noticed. And now they’re lobbying Congress to close that loophole.

Not because they hate innovation or suddenly developed a passion for consumer protection.

But because they hate losing deposits.

THE REAL FIGHT ISN’T ABOUT CRYPTO

On the surface, this looks like another crypto regulation story.

But the real fight isn’t about blockchains, memes, or whether crypto will someday become “real money.”

It’s about something much more boring and much more powerful:

Who gets to pay you for holding money.

Banks have always owned that privilege.

You park your cash.

They pay you a little interest.

They use your deposits to fund loans.

Everyone pretends the system is exciting.

Now digital dollars and fintech platforms are quietly offering alternatives.

Stablecoins are essentially digital dollars that live on the internet instead of inside a bank. Some platforms reward users for holding them, not by paying direct interest, but by sharing trading fees or lending returns.

To consumers, it feels like a better savings account.

To banks, it feels like a crack in the vault.

Once someone else can offer even a slightly better deal, deposits stop being loyal. They start wandering.

And that’s when banks start paying attention.

THE $6 TRILLION NUMBER THAT MADE BANKERS SWEAT

Last week, Bank of America’s CEO dropped a sentence that made every risk manager sit up a little straighter:

Up to $6 trillion in bank deposits could migrate into stablecoins and similar digital products.

Six.

Trillion.

With a “T.”

chart: arkinvest

To put that in perspective: that’s roughly the size of the entire U.S. banking system’s oxygen supply. Deposits aren’t just numbers on a screen. They’re the fuel banks use to make loans, fund businesses, and keep the credit engine running.

→ If deposits leave, lending shrinks.

→ If lending shrinks, borrowing gets more expensive.

→ If borrowing gets more expensive, the real economy feels it.

Translation: this isn’t a crypto headline. This is a plumbing headline.

SPONSOR BREAK presented by Brownstone Research *

Do you have money in any of these banks?

Chase. Bank of America. Citigroup. Wells Fargo. U.S. Bancorp.

If you do…

Click here now because they're preparing for what could be the biggest change to our financial system in 54 years.

DEPOSIT WAR:

1\ On one side:

Banks warning deposits could drain out of the system.

Community lenders worried loan capacity could shrink.

Regulators concerned consumers might confuse yield with safety.

2\ On the other:

Crypto platforms arguing competition benefits users.

Industry leaders warning the U.S. could lose digital dollar leadership.

Users quietly moving money toward better returns and easier apps.

Everyone agrees on one thing:

Money is becoming mobile.

Once cash learns how to move frictionlessly, it doesn’t like being trapped behind low rates and clunky interfaces anymore.

Here’s the quiet part nobody says out loud:

Banks don’t actually compete on savings rates because they never had to.

Deposits were sticky. Switching banks was annoying. Loyalty inertia was powerful.

Stablecoins break that psychology.

They turn money into something that behaves more like an app than an institution.

Download. Transfer. Earn. Move again.

Which explains why even the largest banks are suddenly paying attention.

WHAT THIS MEANS FOR YOU

(EVEN IF YOU NEVER TOUCH CRYPTO)

If lawmakers side with banks:

Stablecoin rewards fade.

Digital dollars start looking like boring checking accounts.

Banks keep tighter control over deposits.

If lawmakers allow competition:

Yields stay competitive.

Money keeps getting more mobile.

Banks face real pressure to evolve.

Either way, the direction is clear: Your money is learning how to shop around.

THE CLOSE:

For decades, banks assumed your money was loyal.

Turns out, your money is just opportunistic.

It wants speed.

It wants yield.

It wants convenience.

It wants options.

And now it finally has them.

Which is why the loudest signal in finance right now isn’t a price chart.

…it’s the sound of bankers nervously watching deposits learn how to walk.

LESSON OF THE DAY:

💬 We Want To Hear Your Story:

Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

Enjoying this post?

Was this email forwarded to you? Don’t miss out on future stories — subscribe to the TradingLessons and get our daily market breakdown delivered straight to your inbox.

❗ P.S. - If you no longer want to receive occasional emails from us and you want to unsubscribe, scroll to the bottom of this email and click the “Unsubscribe” link located right under the disclaimer 👇