Before you scroll down, cast your vote 👇

❗ Got a market or stock you want us to analyze next?

Just drop your request in the comments here.

The S&P 500 kicked off the week with another record high — touching 6,850 in early trading.

That’s a 40% rally since April and a 15% gain year-to-date, powered by strong corporate earnings, optimism over Fed rate cuts, and a tech sector that refuses to slow down.

Momentum looks strong on the surface — but the Relative Strength Index (RSI) is quietly hinting at what comes next.

Quick Market Snapshot:

U.S. markets kicked off the week in rally mode:

S&P 500 ▲ +1.17% | Dow Jones ▲ +0.71% | Nasdaq ▲ +1.86%

A weekend handshake in Malaysia gave stocks their opening boost.

U.S. and Chinese negotiators reached a tentative trade deal that—if finalized—would scrap the looming 100% tariffs on Chinese imports. In return, China pledged to ramp up U.S. soybean purchases and ease rare-earth export restrictions.

But there’s more keeping traders on their toes this week:

The Fed meets Wednesday, and markets are fully pricing in a 25-bp rate cut.

The Magnificent Seven (Meta, Microsoft, Alphabet, Apple, Amazon, Tesla, Nvidia) headline the busiest earnings stretch of the quarter.

The government shutdown drags into week five, delaying key economic data and forcing analysts to rely on partial indicators.

What the Chart Shows

The RSI measures how fast prices are moving and whether buying or selling pressure is getting stretched.

It runs from 0 to 100, but traders focus on three key levels:

Above 70: Overbought — rallies may be overextended.

Below 30: Oversold — selling could be overdone.

Around 50: Neutral — the market’s balanced.

Right now, the S&P 500’s RSI is hovering below previous peaks, suggesting the rally still has room but is showing signs of cooling.

Momentum’s positive — just not accelerating.

SPONSORED:

This Makes NVIDIA Nervous

NVIDIA’s AI chips use huge amounts of power.

But a new chip — powered by “TF3” — could cut energy use by 99%…

And run 10 million times more efficiently.

They control the only commercial foundry in America.

And at under $20 a share, it’s a ground-floor shot at the next tech giant.

Still Climbing, Just Slower Steps

The S&P’s uptrend remains healthy but mature.

With RSI levels easing off the highs, traders should watch for any momentum divergence — early clues of a shift in sentiment.

But for now, the broader structure supports continued strength — just at a steadier pace.

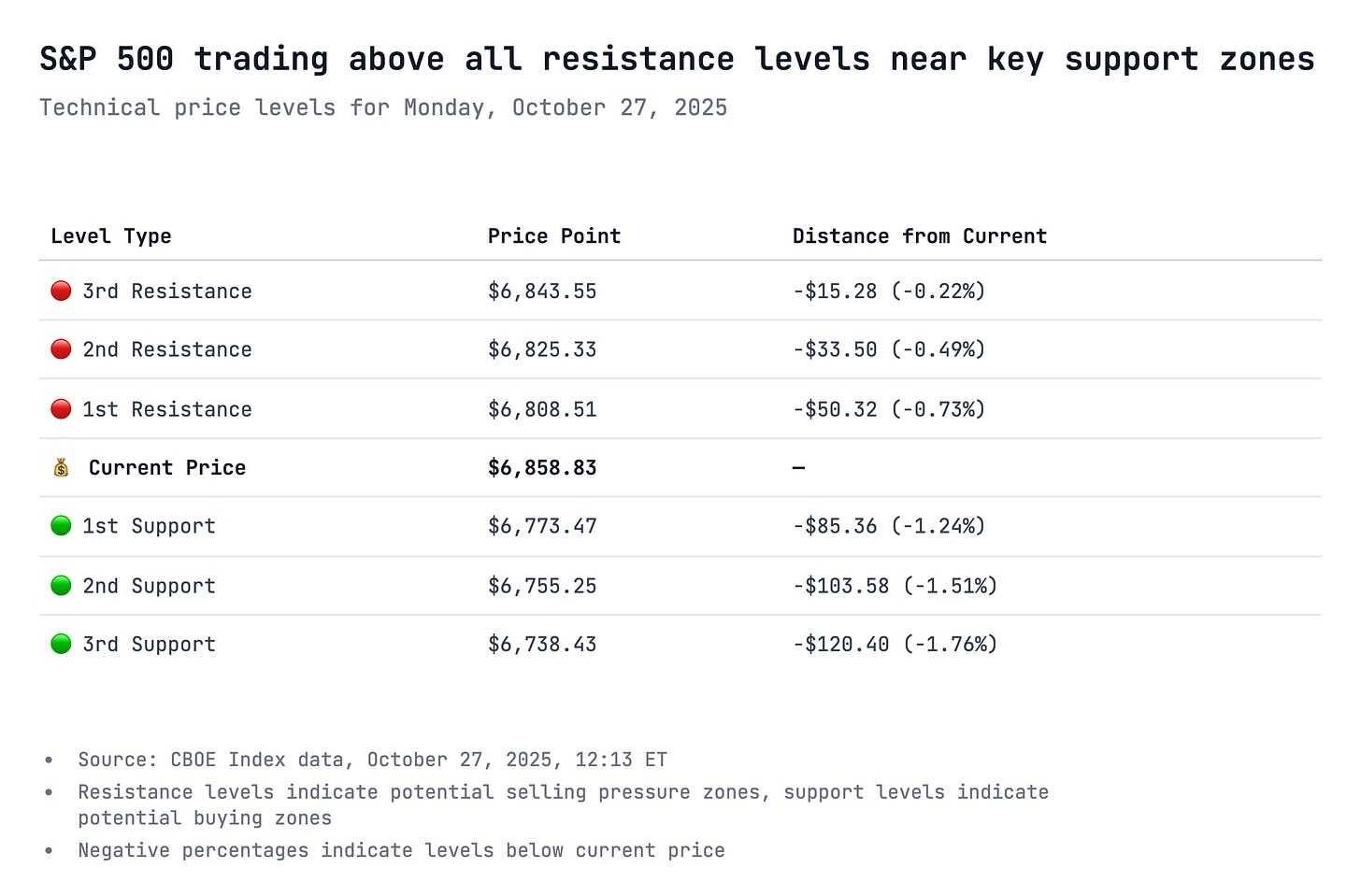

Key Turning Points

Lesson of the Day: Reading the RSI

The Relative Strength Index doesn’t forecast direction. It gauges the strength behind price action.

Momentum fuels every rally, but it’s conviction that decides how long it lasts.

→ When price and RSI rise together, momentum confirms the trend.

→ When price rises but RSI weakens, it signals a possible slowdown — what technicians call bearish divergence.

→ And when RSI holds above 50, it usually means buyers are still in control.

In other words, RSI tells you when enthusiasm is fading, not just when prices are changing.

Every trader’s faced the same question: Do I trust the move — or the momentum behind it?

Share your story: Drop it in the comments here.