It’s been a rough route for UPS.

The shipping giant’s stock has dropped 34% this year — lagging behind FedEx and GXO Logistics — and now trades near its 52-week low around $83.

What’s driving the slump? Three big issues — and one small saving grace.

TRUTH: Not every “cheap” stock is a good deal — some stay on sale for a reason.

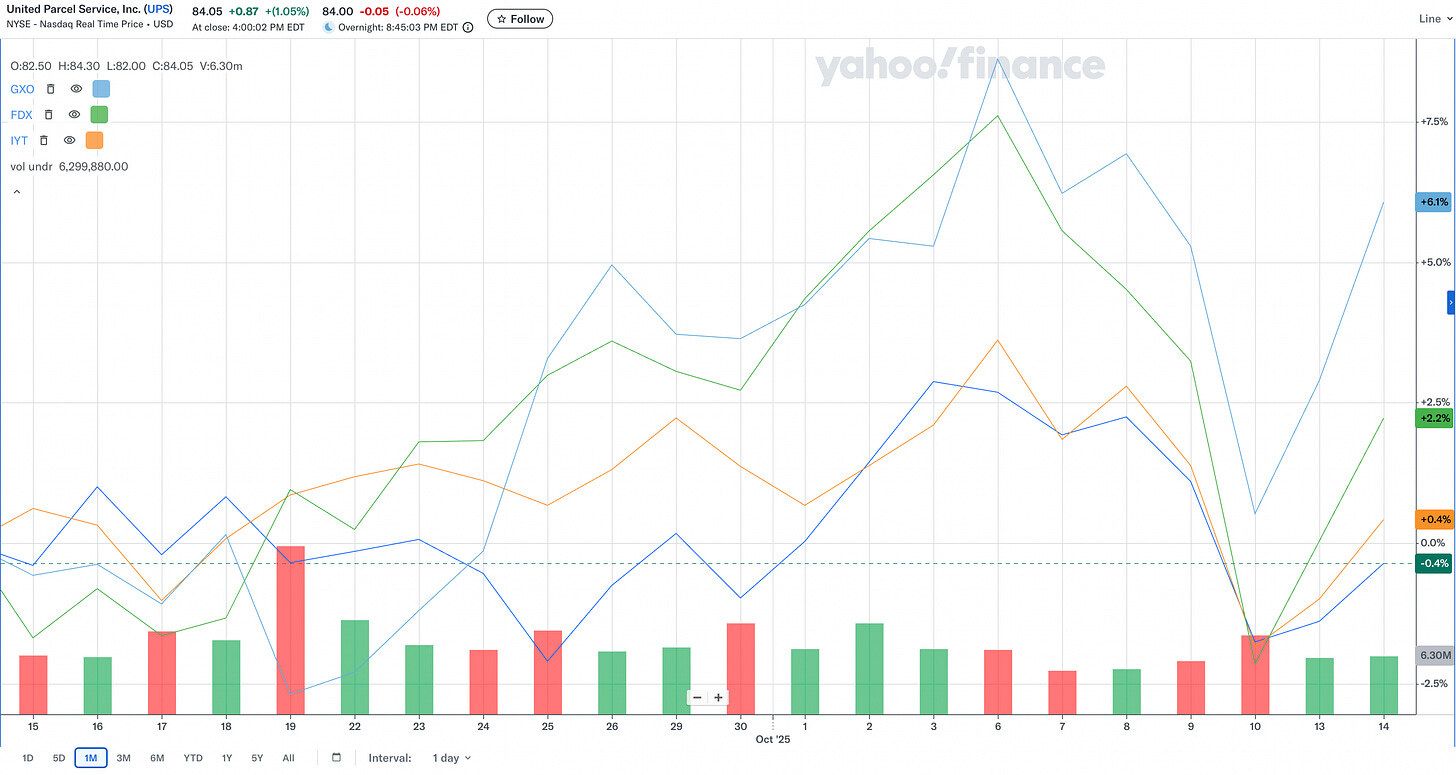

What the Chart Shows

UPS continues to lag its peers in the transport space.

Over the past month:

UPS (blue) has barely recovered from its early-October drop.

FedEx (green) and GXO (orange) both staged sharper rebounds, with FDX finishing roughly +6%, GXO up around +2%, and UPS still flat to negative.

IYT (light blue) — the broader transport ETF — outperformed all three for most of the period.

❗ When one stock in a sector lags this far behind while peers rebound, it’s usually not just “bad luck.” It’s a sign the fundamentals or sentiment haven’t flipped yet — and price action is confirming it.

Trend confirmation > wishful averaging down.

1. The Policy Hit: End of the De Minimis Exemption

That once-sweet exemption that let low-value imports (under $800) bypass taxes? Gone.

Since the rule expired in late August, customs bottlenecks have turned UPS warehouses into parking lots for unprocessed packages.

Shipments are stacking up. Some are reportedly being discarded.

And customers aren’t happy — which means neither are investors.

2. The Dividend Dilemma

UPS still pays one of the fattest dividends in the transport sector — $1.64 per share quarterly — but it’s coming at a cost.

The payout ratio is now 87%, and free cash flow isn’t covering it.

In the first half of 2025, UPS generated just $742 million in free cash flow but paid $2.7 billion in dividends.

Translation: the company’s paying investors more than it’s making.

3. Slowing Demand

Shipping volumes keep sliding. Average daily shipments are down nearly 4% year over year as e-commerce cools and global manufacturing stays weak.

That slowdown forced UPS to pull its 2025 guidance — not exactly confidence-boosting.

Revenue fell 2.7% in Q2, and analysts have been cutting earnings estimates for both 2025 and 2026.

Valuation: The Lone Bright Spot

At roughly 0.8× forward sales, UPS looks cheap on paper — a lower multiple than most peers.

But “cheap” only matters if earnings stabilize. Right now, the numbers suggest otherwise.

Our Take

UPS looks like a value trap in motion — an undervalued stock with over-valued optimism.

The dividend is generous but stretched, and operational headwinds aren’t going away until demand picks up or policy changes.

Until then, it’s one to watch, not one to chase.

Lesson of the Day

Momentum works both ways — and UPS is showing how hard it is to fight the trend when fundamentals weaken.

Cheap stocks can stay cheap for a long time when cash flow can’t keep up.

Lessons Learned

Every trader’s had that one stock they thought was “too cheap to ignore.”

Please share your story: What’s the trade that taught you to wait for the chart and not the dividend yield?

Drop your thoughts in the comments here.

Your story might be exactly what another trader needs to read today.